Part 1: A Raw Introduction to Bitcoin

Part 1 of the "Get Off Zero" Series by Michael Bronson

Welcome to my Newsletter!

I’ve absorbed an incredible array of information throughout the past several years studying financial markets, history, and technology. These studies have all culminated in becoming passionate about Bitcoin and its potential to improve communities around the world. I was first introduced to Bitcoin in 2017, but like many others, had then brushed it off as a quick trend doomed to fail. This all changed in 2020 after graduating college when my perspectives on the global financial system and personal values started to align. I then became motivated to challenge my own misconceptions and media narratives to further explore this emerging innovation. I began to go down a rabbit hole of learning through self-directed research in the form of articles, podcasts, videos, books, and conferences in my free time while working in finance. I quickly recognized the potential of Bitcoin to usher in an ethical alternative to financial services for everyone, everywhere. After internalizing information for a few years and sharing this passion with my friends and family, I finally decided to leap into educational content and crystallize these perspectives. I started drafting these ideas in December of 2022 when the price of BTC was hovering around ~$17,000 USD. The goal of this newsletter is to educate others about money and how Bitcoin fits into global finance as we progress through the digital Information Age. This introductory series titled “Get Off Zero” consists of six parts:

Along with the above, I will occasionally post related articles, news, and resources that add value to further explore and educate. These insights are not all-encompassing, as deeper dives, diverse perspectives, and robust education is needed when learning any new topic or technology. This intro series is intended for a global audience and is meant to scratch the surface for everyone no matter their level of expertise. There are plenty of authors and educators out there that better articulate these ideas, which I share throughout and highlight at the end, but I truly appreciate your time here. Please remain open-minded while reading through this series as I believe reviewing all six parts will be time well spent, especially within Part 4.

Enjoy!

What is Bitcoin?

Bitcoin is an emerging asset that is revolutionizing money and the financial ecosystem. The power and potential of this groundbreaking technology will continue to fundamentally change the way we store, exchange, and interact value with each other on a global scale. Many believe Bitcoin is the most ethical form of money that has ever existed. It has and continues to advance human rights as a tool for incorruptible sovereignty:

It is apolitical yet satisfies the spectrum from libertarians to progressives.

It is peaceful yet disrupts the violent military-industrial complex of the petrodollar.

It is attacked by corporate media narratives as anti-ESG yet is the most ESG-friendly and ESG-incentivizing tech.

It is the antidote to the fiat dollar poison that has exacerbated wealth concentration and squeezed the global middle class for the past 50 years.

These bold claims will be defended and better understood throughout each section, so bear with me.

Existing monetary systems can maximize prosperity and minimize poverty, but as money is only a tool, it can be utilized by good-hearted people or abused by bad actors for the opposite effect. Money today has enabled its own abuse easier than ever. Money around the world has evolved into a system of tainted incentives, shadowy special interests, and derivatives of control ruled by a few corruptible central authorities worldwide. There seems to be a disconnect between traditional wisdom, how our time and energy are spent, and the results of putting in an honest day’s work. There exists the perspective of an increasingly unattainable future that has deepened in recent years, especially among underdeveloped markets and younger generations. Something seems off, and that something can be singled down to the deterioration of money and power structures. These erosions of monetary trust have permeated into a majority of the problems that plague communities all over the world. Half-jokingly, Bitcoin fixes this. Both Bitcoin (the network infrastructure) and bitcoin (the network’s native currency unit) can help liberate people from the chains of central banks’ bottomless debt-fueled fiat experiment. The global debt death spiral of monetary systems and currency debasement appears permanent, but Bitcoin offers a voluntary and decentralized alternative. It is an evolution of the traditional concept of money with the power to shape the future of global finance and humanities for the better.

Created in 2009 by the pseudonymous Satoshi Nakamoto, this decentralized digital commodity uses cryptography to secure value, generate new units, and enforce its capped supply. Cryptography is the computerized encoding and decoding of information (think encrypted e-mails). Its infrastructure enables trustless peer-to-peer transactions backed by math without the need for trusting a central authority or counterparty. Its base protocol layer stores, batches, and transmits packets of information in the digital space without an intermediary, like clockwork. This system has optimized efficiencies to be utilized for the densest form of electronic energy, time, and effort: bits of financial information. Unlike existing forms of debit and credit structures with gatekeepers and complex intermediary layers before finality, BTC provides final settlement every ~10 minutes: no middleman muck, no CEO mouthpieces, no unelected bankers, no corruptible central authorities, no problem.

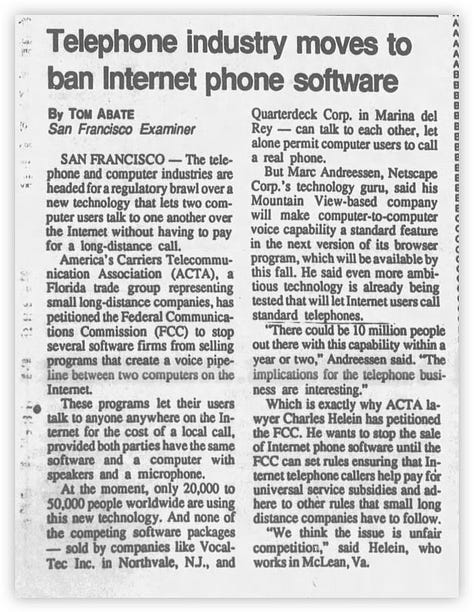

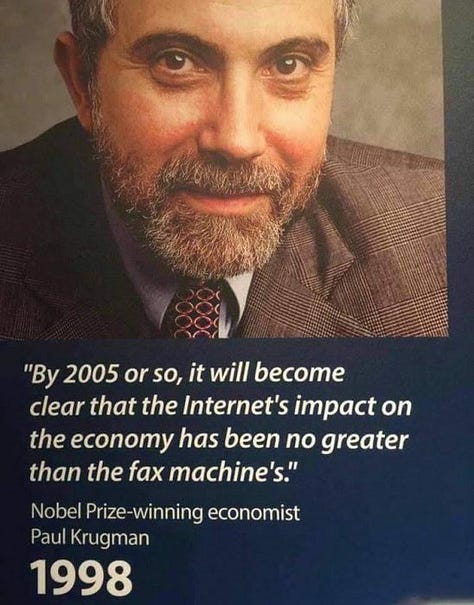

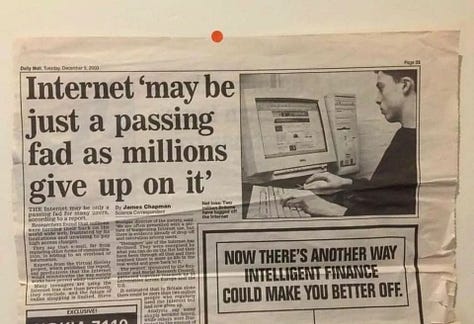

Despite hundreds of articles declaring its death since 2010, Bitcoin is here to stay. You can store value in a bank in cyberspace with no counterparty risk and transfer that value cheaper, faster, safer, more equitably, and more ethically than any other asset, commodity, or currency. Try securely transferring $2 billion worth of gold, real estate, or cash across the world for only $0.42, or sending less than $0.01 of value in milliseconds with zero friction. Years of computer innovations combined with software operate this network backed by math, code, and watts, instead of fiat money’s guns, debt, and trust, and can be used by anyone, anywhere, at any time. However, it is not a one-trick pony. Depending on the individual or group, Bitcoin can be viewed as a complement or alternative to a: savings account, checking account, personal portfolio, remittance network, corporate treasury reserve asset, emerging market currency, economic settlement network, nation-state treasury reserve asset, seizure-resistant asset, institutional investment, digital gold, and/or insurance against corruption. Allocation percentages across these buckets vary and can depend on individual circumstances, regulatory jurisdictions, retirement strategies, time horizons, and convictions. It is difficult to understand any new technology off the bat, especially when that emerging tech disrupts the mental framework of how existing systems operate. As we’ve learned with every innovation, you cannot judge a system from within a system. The same criticisms of Bitcoin today mirror that of television, computers, the internet, e-mail, and smartphones, all of which had their societal implications not fully realized at first glance (or first decade):

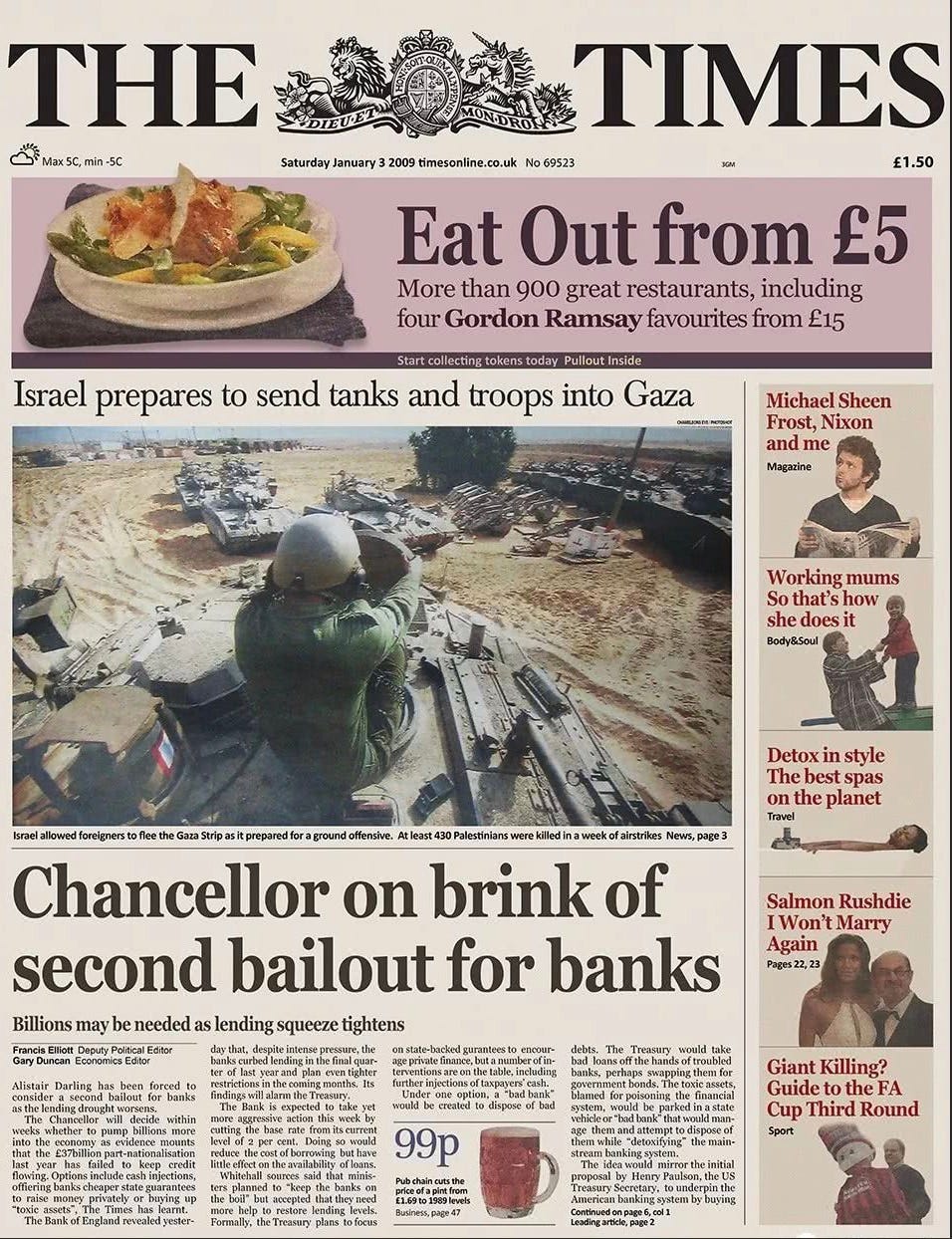

One can also think about the impact of the printing press in the 1500s and how it enabled the duplication and velocity of information that didn’t exist before, like that of Martin Luther’s 95 Theses. The Protestant Reformation challenged the existing monopoly on religion, its power, and its rule of law at the time. Nakamoto published the Bitcoin Whitepaper on the 491st anniversary of Luther’s. Like Luther, Nakamoto challenged the existing monopoly on money, its power, and its rule of law of today’s central banking and political currency units called dollars. The whitepaper release also happened to be on the same day as Halloween in 2008, birthed out of the global financial chaos and corruption, and offered an alternative solution to central banking. This was evidenced in the first Bitcoin block mined a couple of months later, with a newspaper headline permanently inscribed by Nakamoto, “The Times 03/Jan/2009 Chancellor On Brink of Second Bailout for Banks.”

The Occupy Wall Street Movement also stemmed from The Great Financial Crisis of 2008, fueling anger over the banking system to bail out incompetent and greedy banksters. Unfortunately, this outrage seemed to have disappeared overnight a decade ago, with both sides of mainstream media pivoting away from holding our system accountable, peeling back the curtain of how the banking system operated, and, subsequently, public outcry and attention dissipated. The next decade would be fueled by easy-money interventions like quantitative easing and zero-interest-rate policies. Despite some regulatory improvements at the time, corporate manipulation and corruption continue to compound across the globe today, with central authorities becoming more concentrated and concerted, kicking the fiscal can down the road, and squeezing short-term greed at the long-term detriment of billions of peoples’ currencies and liberties due to the inevitable corrosion of power dynamics. Fourteen years later, Bitcoin continues unscathed. During the March 2020 financial markets’ crashes filled with trading halts and closures, Bitcoin (the network) operated flawlessly while bitcoin (the asset unit) had its USD convertible rate volatile in line with other assets. This peer-to-peer, bottom-up technology is a revolutionary tool for humanity to prosper as we progress through the early innings of the digital Information Age. The current global economic system is trending toward a dystopian future, but the antifragility of Bitcoin will continue to help populations survive (literally), thrive, and combat increasingly centralized tyranny in many parts of the globe.

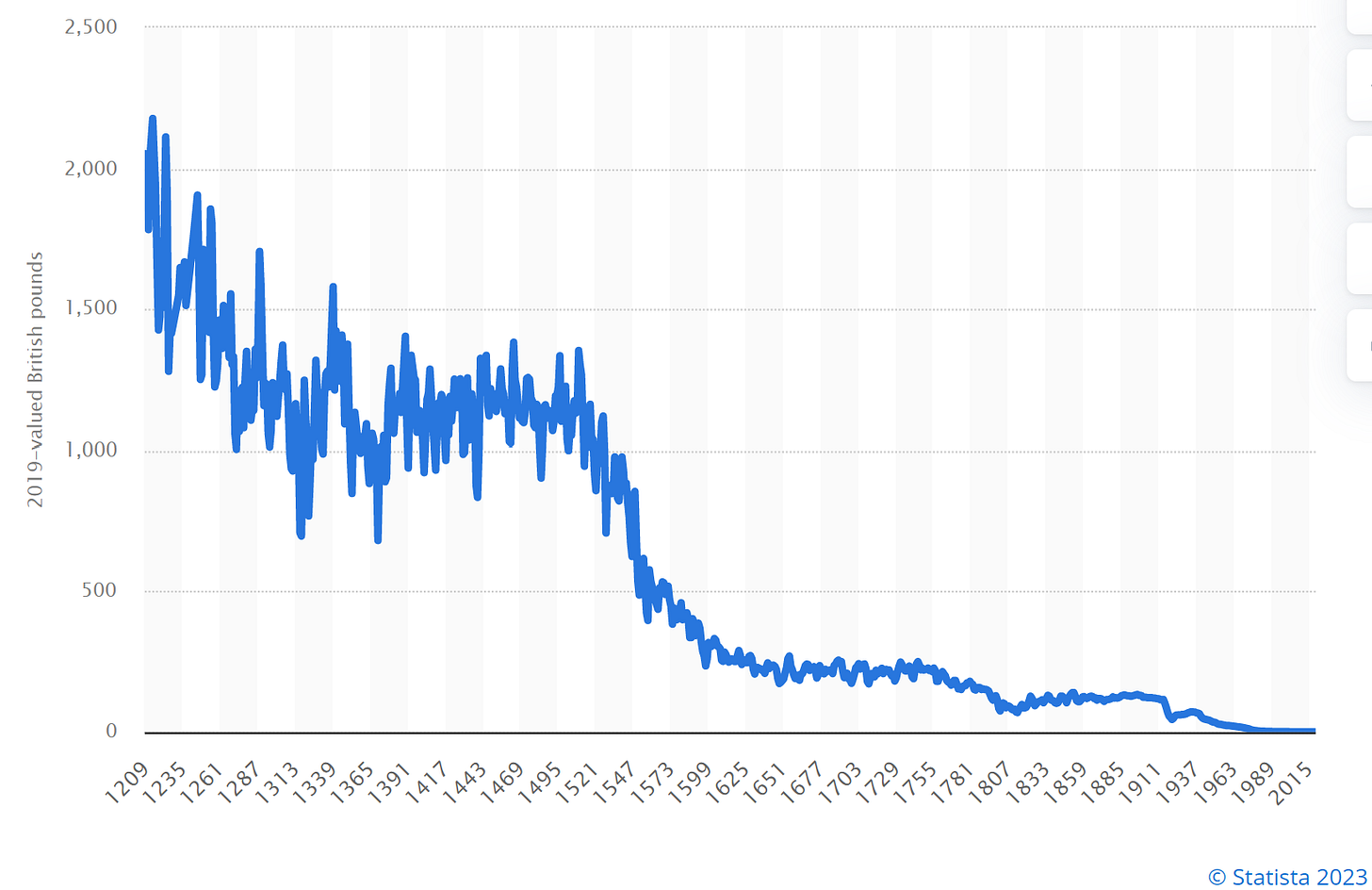

Bitcoin is software code that enforces property rights. It catalyzes the digital age with a native asset that can be used as sound money by anyone. It is an escape valve from the fiat debt death spiral, and even the European Central Bank chair herself slipped to admit this. Central banks around the world are stuck between a rock and a hard place: default on their sovereign fiat currency or debase its money supply towards sustained inflation, bleeding out purchasing power over time. This dance between ruling powers and their currencies rhymes with every historical era. Just look at the purchasing power of our former world reserve currency the Great British Pound:

Although technology is deflationary, the USD has lost 97% of its purchasing power since the Federal Reserve was established in 1913. The supply of the US Dollar and the USA’s $32 trillion in debt is on an unsustainable path. But it’s the world's reserve currency anyways, so it will remain so for another century and nothing bad can happen. Right?

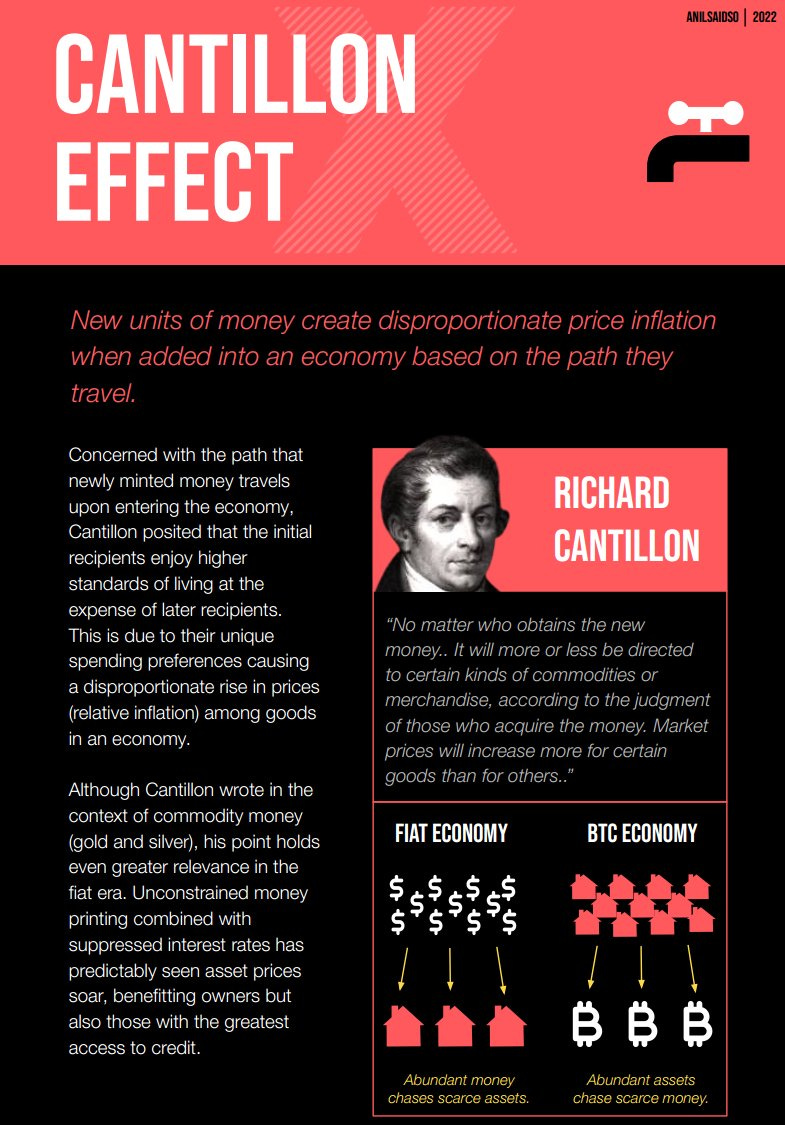

Nearly half of all governments’ fiat currency supply worldwide was introduced into the global economy in the past 3 years, in response to the war on covid and in line with prior wars. This also means nearly half of all savings accounts worldwide have been devalued in half on average. The financially privileged US citizens are closest to the USD money faucet and enjoy a work-ethic-rewarding economy and higher standards of living relative to other countries, but are farthest from truly understanding and experiencing the detrimental impact in short order. This notable proximity to the money printer gives US citizens greater advantages than foreigners halfway across the world who also rely on the USD, which was dubbed the Cantillon Effect:

This will be explained in further detail in Part 4 and is better articulated in The Human Rights Foundation-sponsored book Check Your Financial Privilege. Social credit dystopias like the experiment in China of central bank digital currencies (CBDCs) have and will continue to falsely emerge as the antidote to the fiat dysfunction currently going on in the global economy. Unfortunately, it is simply a marketing tool to rebrand the same old to usher in even more power and control via programmable, perishable, limited, and rights-infringing digital fiat. Fortunately, Bitcoin’s creation gave us the true antidote to various fiats’ poisonous societal effects before it was absolutely necessary. With banking censorship from human rights protests globally, totalitarian corruptible systems are one more “emergency” away from violating civil liberties through tyrannical “upgraded money”. For your health and safety, of course. The censorships, gateways, limits, controls, and failures will bittersweetly improve awareness of Bitcoin’s value propositions. It’s a matter of when, not if, as it is already happening behind the curtain across the world. The Chinese Communist Party has integrated its digital surveillance with its national currency, and some US lawmakers are somehow vouching for the same. Chinese citizens “enjoy” expiration dates on “their” money, rejections for purchasing “their” everyday items like food or bus tickets if caught J-walking or watching The Big Bang Theory, and complete freezes or seizures of “their” money if they happen to criticize CCP leadership. This is the extreme spectrum of monetary control in the digital age that governments around the world are experimenting with today. Luckily for everyone, there finally exists a voluntary alternative. Millions of underbanked and disadvantaged populations already rely on Bitcoin’s technology, and its adoption curve has been analogous to any new technology, especially in FinTech:

Bitcoin's emergence has disrupted traditional financial institutions and sparked a discussion about the separation of money and state as we mature into the 21st century. Its growing adoption by merchants, consumers, and investors as a viable complement to traditional currencies and financial instruments has only solidified its position as a revolutionary tool and natural evolution of money for the digital age. The increasing adoption of Bitcoin globally will continue to shape banking, economic, and humanitarian trends as a viable alternative for anyone with a cell phone, internet, or even satellite connection.

There is no central server, so the only way to “stop” the network would be to disable all internet, cell, and satellite connectivity worldwide in an EMP-like fashion. Even then, its base layer transactions would only be paused until the resumption of connectivity, and there would be greater issues on the beat to deal with anyways (hospitals, trade, credit cards, ATMs, food, transportation, HVAC, etc). The concept of money has evolved throughout history to reflect ruling kingdoms’ power and technological advancements and will continue to do so in the future as we transcend from the analog, physical realm into the digital dimension of the decentralized, trustlessly verifiable, math-backed, sovereign financial tool in BTC. As Jamie Griffin questions as we progress as a globalized digital economy, “Does it make more sense for the reserve currency to be globally neutral money, or money that is controlled by one country?”

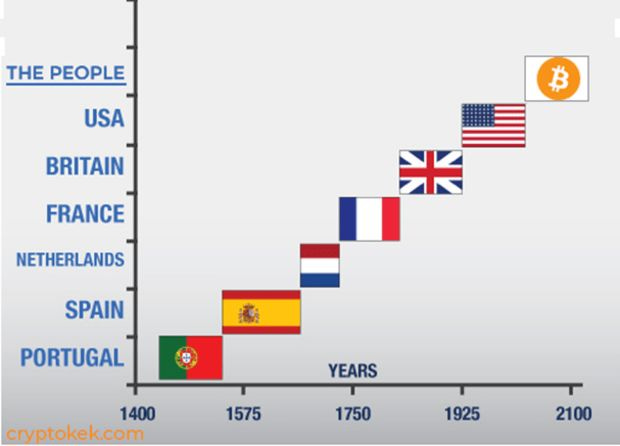

History does not repeat itself, but it does rhyme. And if the history of civilizations, power dynamics, geopolitical game theory, and money teach us anything, it’s that human ingenuity and energy efforts will flow towards the most secure, powerful, sound, native-aged money over time. The US century-long stronghold on money is in the hot seat after the gold standard inflection point from 1971 and the “everything bubble” we see today that mathematically requires more money printing to stay afloat. Every long-term thinking individual or business invests a portion of their net worth into a portfolio, which essentially tries to be a better money basket for their savings than simply holding cash does. Wherever your mix of stocks, bonds, real estate, gold, and cash fall, your goal is to preserve purchasing power over time against risks like the depreciating fiat dollar. It is counterintuitive to subject your money conversions to riskier buckets to yield a reward that outpaces inflation after all. Why not just store it in cash under your mattress? Because of the physical risk to defend it, not to mention inflation risk. This did not work out well throughout history, especially in the past century for Germans, Hungarians, Yugoslavs, Zimbabweans, Venezuelans, Argentines, Nigerians, or Lebanese people. There is only one asset, however, that is subject only to market risk (how others value it at any point in time based on supply and demand) versus key-man risk (a CEO), counter-party risk (trusting other intermediaries), inflation risk (printing more supply debasing its units), among dozens of others. After all, your property (money, time, energy, assets) only goes as far as you can protect it (against burglars, natural disasters, fraud, or corruptible authorities):

Simplified, your Bitcoin can be defended by memorizing a password and taking self-custody. There are no rule-changing gatekeepers, freezes, outright seizures, or civil asset forfeiture on the base layer like in all other alternatives that historically manipulate and inevitably become corrupted. The majority of people do not want to be a financial planner, study economics, watch CNBC, or pick stocks. You just want to work an honest living, do what you love, be with your family, and save up money for the future so that you’re able to buy the things you need to live and the things you want to enjoy. Because no one can change its fixed supply, is transparently audited every second in a distributed and decentralized manner, and is enforced through code and backed by energy, Bitcoin allows people to save in this asset and hold that value long-term without needing to be a financial professional. Some might say, “Oh, Bitcoin doesn’t interest me, I’m not interested in finance.” That’s the point. You don’t need to be an investment manager or economist or stock guru to be able to store your wealth, time, and energy for the long run. There is short-term volatility, but it is a scarce asset going through an adoption phase. The market psychology of FOMO-buying, panic-selling, regret, and hubris continues to repeat every cycle:

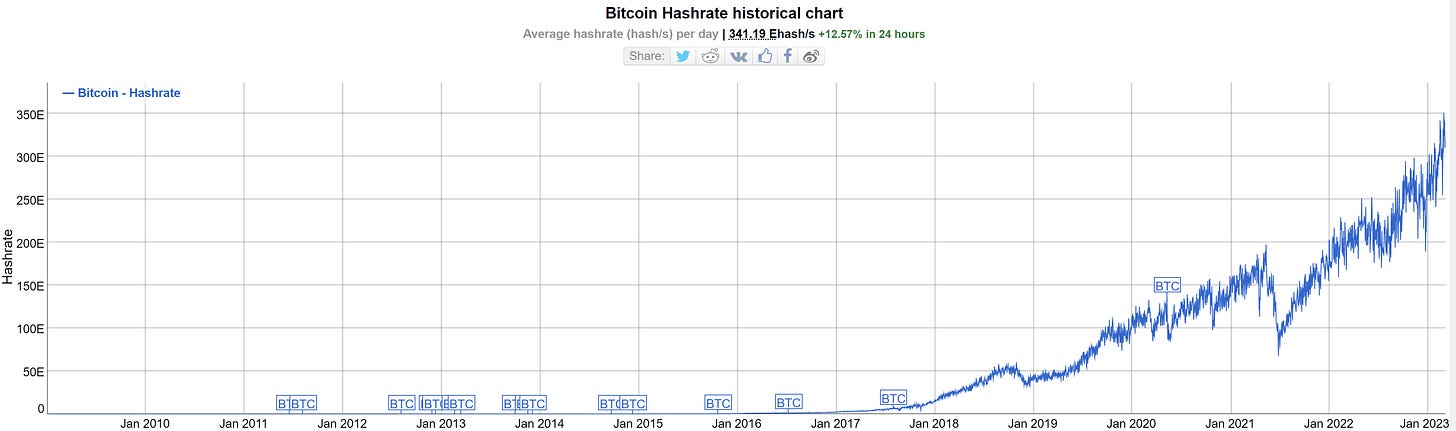

Bitcoin the network has operated flawlessly for a decade, while bitcoin the currency unit fluctuates against the USD as an emerging asset going through price discovery. Observing cycles of reaching $6, crashing to $2, $60 —> $20, $600 —> $200, $6k —> $2k, and $60k —> $20k reveals a pattern. However, “past performance is not indicative of future results.” Fundamentally, Bitcoin is poised to appreciate in value via market dynamics of supply and demand while existing systems of political currency units and trust in power structures continue to erode. There are over 8 billion people in the world, and less than 1% own BTC so far, so of course it’s going to be volatile in the short term. But both adoption (number of wallets holding BTC) and hashrate (demand to mine BTC) continue to climb to all-time-highs:

The world is volatile, especially as of late. But on a longer-term basis, Bitcoin’s purchasing power has been shown to increase when zooming out. It is not a get-rich-quick scheme, it is a preserve-your-wealth-over-decades scheme. Bitcoin is insurance and a voluntary silent protest against unchecked tyranny, back-door corruption, and monetary debasement. Bitcoin is by the people, for the people, for the existing and future disadvantaged, and for human rights. It is riskier to have no exposure to this freedom technology for your family’s wealth preservation over time than not, no matter where you are from, where you are living, or where you are going. It makes a good case for where ethical progress and value will grow as the soundest money, as every civilization and world reserve asset has in the past. But to understand why and how, we first need to understand money, its history, and where it’s headed in Part 2: A Brief History of Money & the Emergence of Bitcoin.

In the meantime, increase your Bitcoin knowledge, understanding, and allocation above “0”, aka Get Off Zero.

Disclaimer:

The above content and resources are for educational purposes only and not financial advice. Should you choose to apply the practices described in the above and/or linked content with bitcoin you own now or may purchase in the future, you do so at your own risk and I shall in no event be liable for any financial loss suffered.