Part 4: The Humanitarian Case for Bitcoin

Part 4 of the "Get Off Zero" Series by Michael Bronson

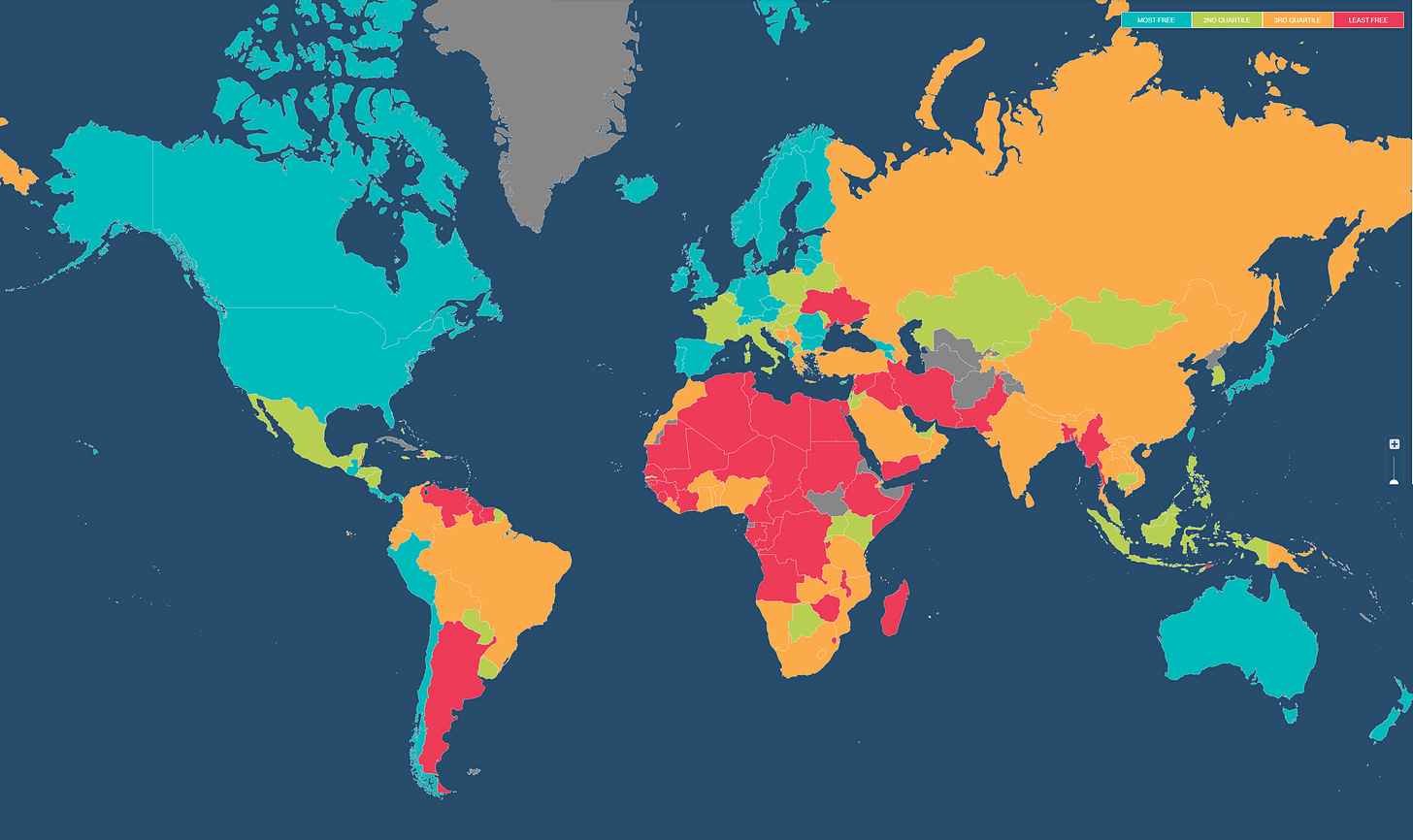

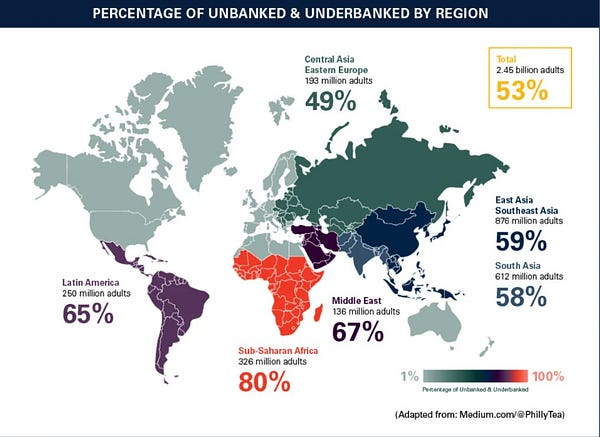

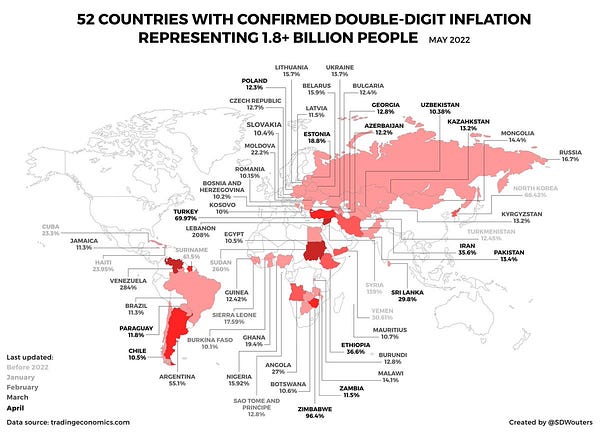

Bitcoin provides unfettered access to banking and financial services for all, without tiered bias or censorship against your: class, race, gender, ethnicity, physical location, regulatory jurisdiction, credit score, religion, age, accreditation, education, beliefs, and background. This is especially true for individuals who have had subpar gateways to traditional or corrupted services depending on where they happened to be born. In many parts of the world, there is a lack of access to banks and other wealth management tools which makes it extremely difficult to save and invest money to outpace inflationary pressures and preserve their families’ wealth over time. The current map of the global Economic Freedom index is shown below:

Bitcoin provides a permissionless way to enjoy financial services and participate in local, digital, and global economies. It is an open, verifiable, and honest monetary protocol that contrasts with flavors of the fiat system exhibited throughout the world. The existence of this tool is transforming fintech services and keeping traditional banking in check by offering an alternative that incentivizes truth, reduces corruption, and improves transparency. Because Bitcoin operates on a decentralized network and uses a public ledger to record transactions, as opposed to trusting intermediaries, it is impossible to collude, manipulate, or falsify records. The BTC network itself has never been hacked or defrauded in its 14-year history, although centralized exchanges that provide fiat on-and-off-ramp and outsourced custody services have due to the inherent security and trust risks of centralized counterparties. Bitcoin offers an incorruptible and voluntary alternative to bank billions of people worldwide, particularly in areas where traditional financial systems were or are prone to manipulation.

Global Unrest:

Since 2017 alone, there have been over 450 significant protests worldwide from local communities demanding reform against central authorities due to their rights-infringing policies involving financial, property, political, or corruption-related matters. When the base monetary protocol is untruthful, unaccountable, and broken, every system of power operating on top inevitably erodes. Some global examples are shown below:

“Power corrupts, and absolute power corrupts absolutely.” ~ anonymous

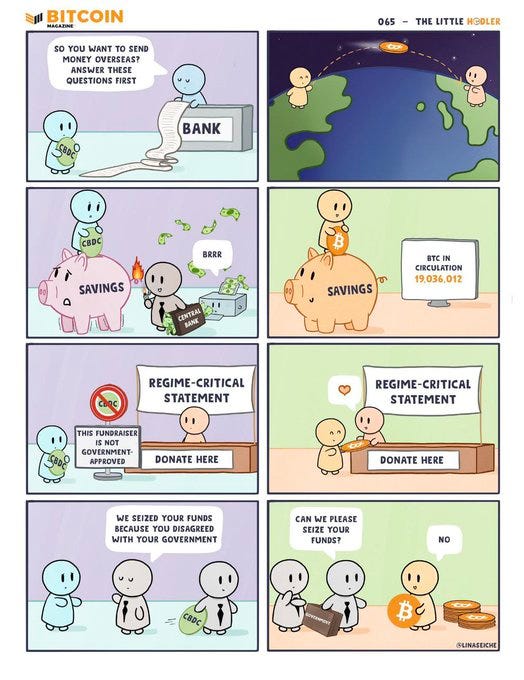

It is heartbreaking that central authorities can hijack livelihoods on a whim, simply because our property (our bodies, our minds, our homes, and our wealth) is subject to corruptible legislation, like lobbying and back-door deals, and can be compromised for non-compliance or even speaking out. These power structures are enabled by the Proof-of-Stake fiat and political systems, where bureaucracies can rewrite the rules and enforce them with coordinated overreach, even if they go against the best interest of their own people. Embracing an alternative to the base monetary protocol that is instead truthful, accountable, transparent, fair, and truly democratized, every system of power operating on top inevitably transfers power consensus from oligarchs and bureaucrats back to the people in an enhanced representative manner, without bias or permission. Sure, democracies vote for leaders in elections to operate on behalf of their constituents’ best interests, but the existence of lobbying alone (among other things) completely dismantles the idea of a democratic republic and truly representative government. Governments were originally formalized to serve their people but have since been perverted inversely with more envelope-pushing to test the limits of human, property, and civil rights thanks to the erosion of fiat-based power structures. This has especially been true in recent years. Saifedean Ammous brilliantly dissects these issues in his book, The Fiat Standard, which I highly recommend reading before passing judgement on the above claims.

Better Money for the Digital World:

There are historical examples of the positive impact that Bitcoin has had and continues to have on humanitarian efforts. The use of Bitcoin’s borderless and instant settlement network helps facilitate the flow of aid and donations to affected areas or causes, without middlemen muck that absorbs fees and administrative costs which vastly mitigate the intent and financial impact by the time they reach their destination. There have been different scales of the above but were first notable during the Ebola outbreak in West Africa in 2014. This was further highlighted during the onset of the Ukraine conflict beginning in 2022, in which Bitcoin enabled instantaneous donations for the citizens and its government from anyone anywhere around the world. Unfortunately for some citizens trying to flee their war-zoned country, Ukrainians had their fiat, jewelry, and gold bars confiscated at the border while escaping to keep their families safe. The same goes for Russian citizens that wholeheartedly disagree with their war-mongering leader, yet despite that, had been entirely cut off from the US Dollar system simply because of where they live or were born. I personally have a friend who has lived in the States for over a decade but is from Russia where their family still resides today. A year ago they had their bank account frozen and an expensive years-long prepaid vacation to visit their family completely canceled and nonrefundable, simply due to second-hand consequences of their nonconsensual affiliation with Putin and nonsensical politicization of money. Traditional financial systems are often inefficient and prevent lawful citizens from traveling outside their country over a certain threshold of valuables or cash. The use of BTC has allowed for faster, cheaper, more secure, and more ethical wealth preservation, relocation, and transaction around the globe no matter the cause.

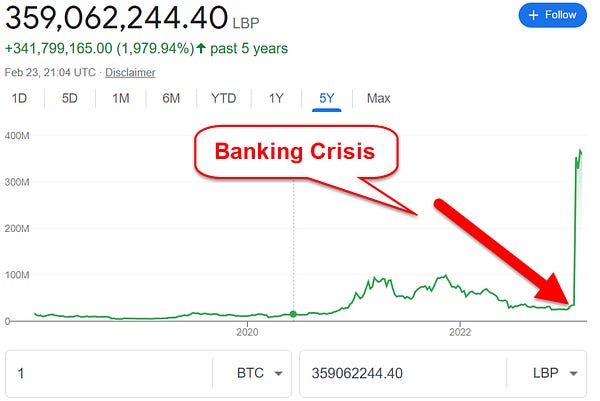

There are scores of pro-Bitcoin municipalities across the world, varying from legal tender status to permitted usage. Countries such as El Salvador and the Central African Republic, and specific cities like Lugano, Switzerland and Madeira, Spain, have adopted Bitcoin as outright legal tender for valid government payments and commerce. These countries and other regions have historically been negatively affected by the fiat system and taken advantage of with external loans and financial gatekeepers residing halfway across the world. Citizens and advocates from these countries have lived a completely different perspective of power structures from what US citizens have subconsciously enjoyed simply because of where they happened to be born. Alex Gladstein of the Human Rights Foundation, and author of Check Your Financial Privilege, details how central authorities like the IMF and World Bank have eroded their initial purpose of helping disadvantaged communities here if interested in learning more. The top usage of Bitcoin per capita understandably comes from historically unbanked or underdeveloped areas where it is a matter of life or death to securely store and transfer value without exorbitant fees or hyperinflation, like Nigeria, Vietnam, Argentina, Turkey, and Lebanon. Governments are faced with a dilemma regarding the regulation of BTC: ignore it as they claim it is not valuable and useless, or oppose/tax/ban it as they believe it will challenge their fiat monopoly on power and control, yielding a Streisand Effect. So the next time you see a derogatory headline about the b-word, think deeper about the motivations for deceit behind them.

“It is apolitical yet satisfies the spectrum from libertarians to progressives,” (from Part 1).

Bitcoin itself is an apolitical, permissionless, and unbiased tool as a technology protocol. However, there are die-hard libertarians, extreme progressives, and everyone in between that are pro-Bitcoin for various reasons. Libertarians support Bitcoin because they believe in individualistic liberties, local governance, and property rights. They see Bitcoin as a way to transact and store wealth without corruptible friction from governments, central banks, and other intermediaries that plague the existing system today, such as eminent domain and civil asset forfeiture. Progressives on the other end of the spectrum support Bitcoin because they believe in social justice, social equity, banking the under-banked, and equal treatment and access no matter your identity or background. They see Bitcoin empowering people who have been excluded from traditional financial systems, such as those living in countries or towns with unstable currencies, biases, or high levels of corruption. They also see Bitcoin as a way to promote environmental causes, expose the societal shortcomings of fiat, defund war efforts, incentivize peace, close the wealth gap, help marginalized communities, and challenge the increasing power of large institutions to promote prosperity. Despite mainstream narratives and intense tribalism exhibited today, the majority of people politically land in the middle and can agree with arguments from both extremes.

“It is attacked by mainstream narratives as anti-ESG yet is the most ESG-friendly and incentivizing ecosystem,” (from Part 1).

ESG stands for "Environmental, Social, and Governance," and refers to the three main categories of criteria used to evaluate a model of global sustainability and the social impact of a company or investment. It was birthed with good intentions and sounds good on the surface, but has recently been taken advantage of by corporate conglomerates for shaping further capital controls and political narratives, no matter how off base. Here is a thought-provoking thread about the second-largest asset manager in the world below:

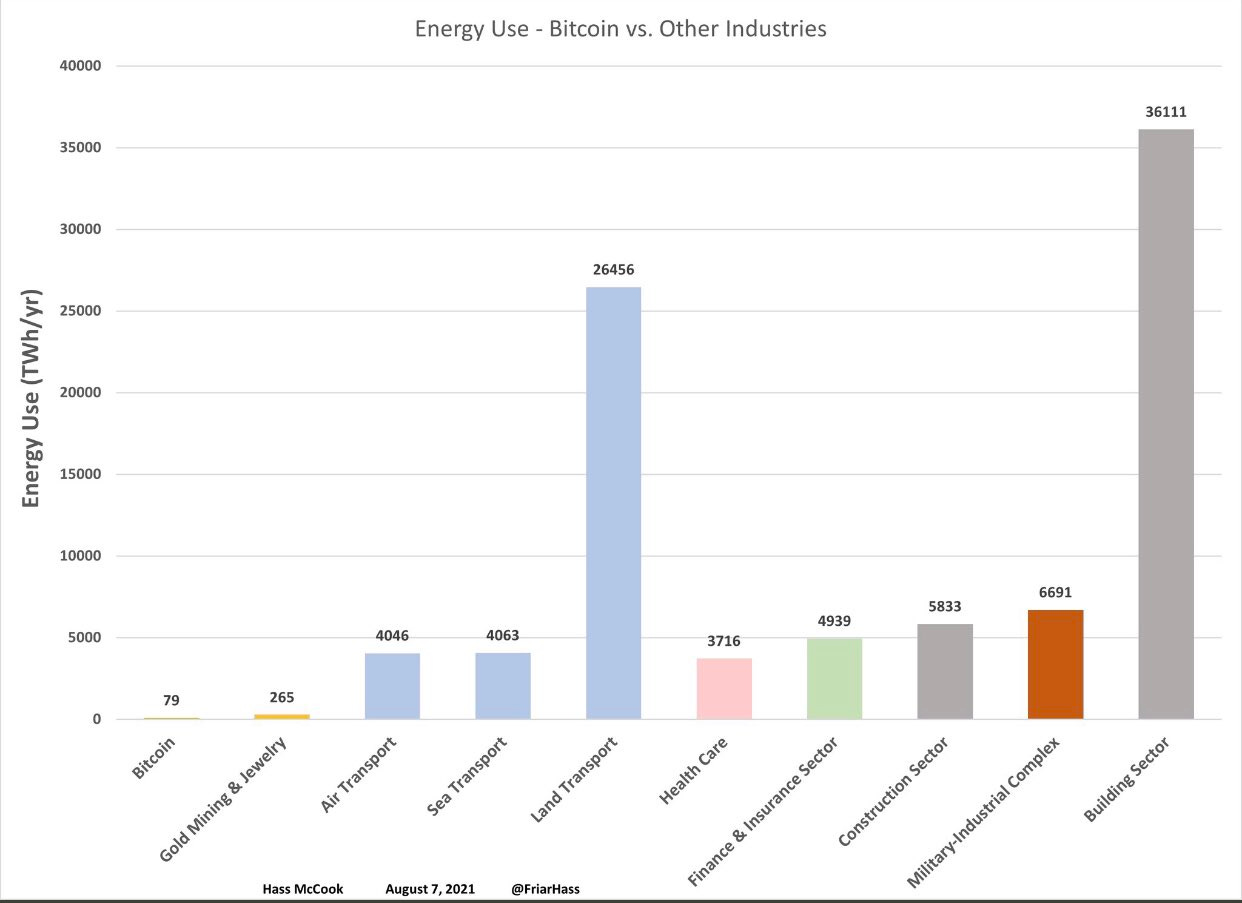

In its true form encompassing all 3 letter pillars, Bitcoin is the most ESG-friendly technology because its ecosystems and operations align with and further incentivize ESG values. Saying Bitcoin is bad for the environment is not an opinion, but rather an uneducated claim rooted in debunked lies and misunderstandings about its energy usage (see the 2017 article “Bitcoin Mining on Track to Consume All of the World's Energy by 2020“ that is head-scratchingly still regurgitated today, 3 years after the world was supposed to end). The truth is, we’d be surprised if the existing corporate powers didn’t push back on BTC adoption and its countless benefits to society, even based on their own ESG framework, as it disrupts their stronghold on centralized power, wealth, narratives, human attention, and subsequent coercion. Before weighing in on the Bitcoin energy debate, one should look into carbon intensity/energy mix, transmission loss, Proof of Work, curtailed/stranded energy, settlement assurances, deferred settlement, energy vs electricity production, and payments vs settlement. Below are some arguments for each of the ESG categories:

Bitcoin mining, the process by which new bitcoins are generated and secured, requires energy input like any other impactful tool. Its operation and Proof-of-Work mechanisms obey the laws of physics, energy, and thermodynamics. However, it is more environmentally friendly than other forms of monetary and financial systems. Bitcoin's decentralized nature means that it does not rely on the extent of physical infrastructure seen in the traditional financial industry, such as bank branches, locational headquarters, ATMs, the physical carbon footprint of funding wars, industry employees, and other stakeholders like central banks and their gold storage/transfers, investment management companies, their invested companies, and supply chain holistically engaging in work and its ecosystem. BTC’s alternative is making the existing framework increasingly obsolete and reducing the environmental impact of financial system hubs of employees, equipment, factories, and the like, worldwide.

It’s interesting that for every negative narrative about BTC, they conveniently ignore an apples-to-apples comparison of the existing system. Why is there no outrage for data centers that use up energy purely for entertainment purposes? Is there a difference between TMZ, ESPN, or OF if they’re all blanketed under entertainment? What is the footprint of Netflix and households that stream constantly? The point is, who can arbitrarily decide what constitutes “wasting energy” and how? Bitcoin is a necessity for the world, so they might want to start someplace else with operational forms that are not needed, but rather desired, to inspect energy usage.

Additionally, not only can Bitcoin mining be powered by renewable energy sources on far greater scales than alternative monetary or technology systems, but the mining ecosystem incentivizes cleaner improvements. Pipelines exist because the energy density and use of oil cannot be teleported from the source to where it’s needed most, and vice-versa. Bitcoin miners are the first-and-last-buyers-of-resort when it comes to energy systems and can operate anywhere, or mobilize to where energy is being unused or otherwise wasted, both clean and dirty sources. There is no other energy utilization technology that helps balance electrical grids to maximize efficiencies as much as mining bitcoin. Bitcoin mining has the unique ability to turn on or off at any time, providing power back to grid systems when it is needed the most, and using electrical power that is otherwise wasted. More details are seen in this video below:

Others are utilizing bitcoin mining to improve their communities. Gridless Compute is a West African company that helps finance remote excess hydro to power rural villages and secure the network while lowering electricity rates by ~60%, all with what would be otherwise wasted power. Lago Bitcoin in Guatemala utilizes used cooking oil to mine bitcoin, oil that would otherwise end up in Lake Atitlan. Vespene Energy in the US is monetizing methane waste in landfills, which is actually net carbon negative by using wasted gas that fills into the atmosphere. The largest oil companies like Shell, Exxon, and Chevron are experimenting with attaching Bitcoin miners to wasted flare gas from oil field rigs, yielding carbon negative capture to convert otherwise wasted energy and secure an equitable bank in cyberspace. El Salvador is utilizing volcanoes and their natural energy to power mining facilities, volcanic energy that is otherwise wasted into the atmosphere at massive scales larger in one year than most people expend in their lifetimes. Bloem Bitcoin in the Netherlands uses the heat from bitcoin mining equipment to help grow and dry agriculture. Plenty of miner attachments are coming into the market for these heaters to go mainstream, heating everything from homes to businesses at a fraction of the cost and multiples of the positive impacts for society. Yes, you can now heat your home for net cheaper costs while also earning BTC as a dual technology, essentially double-spending energy input. A whole series could be dedicated to how Bitcoin mining is helping to utilize, stabilize, and balance energy grids, oceanic power, biogas, wasted car tires, etc.

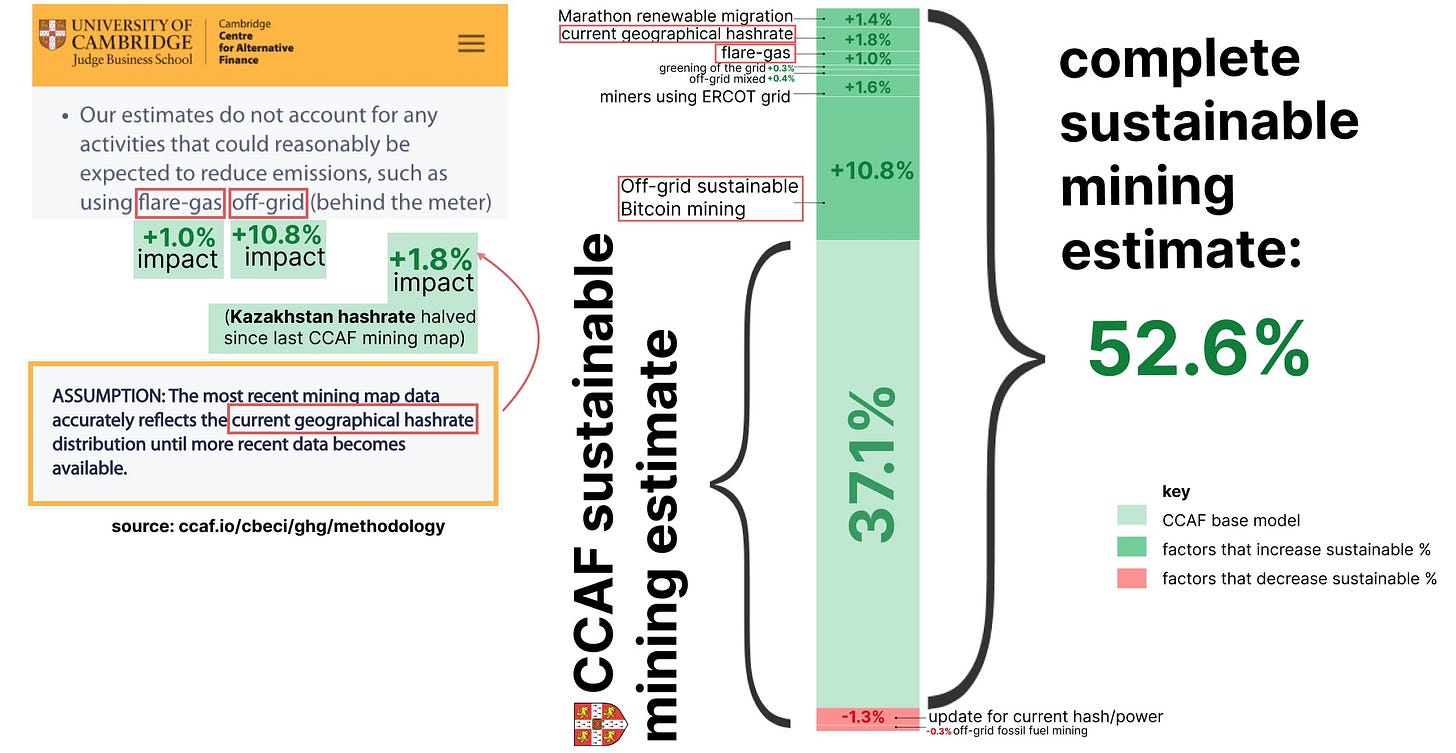

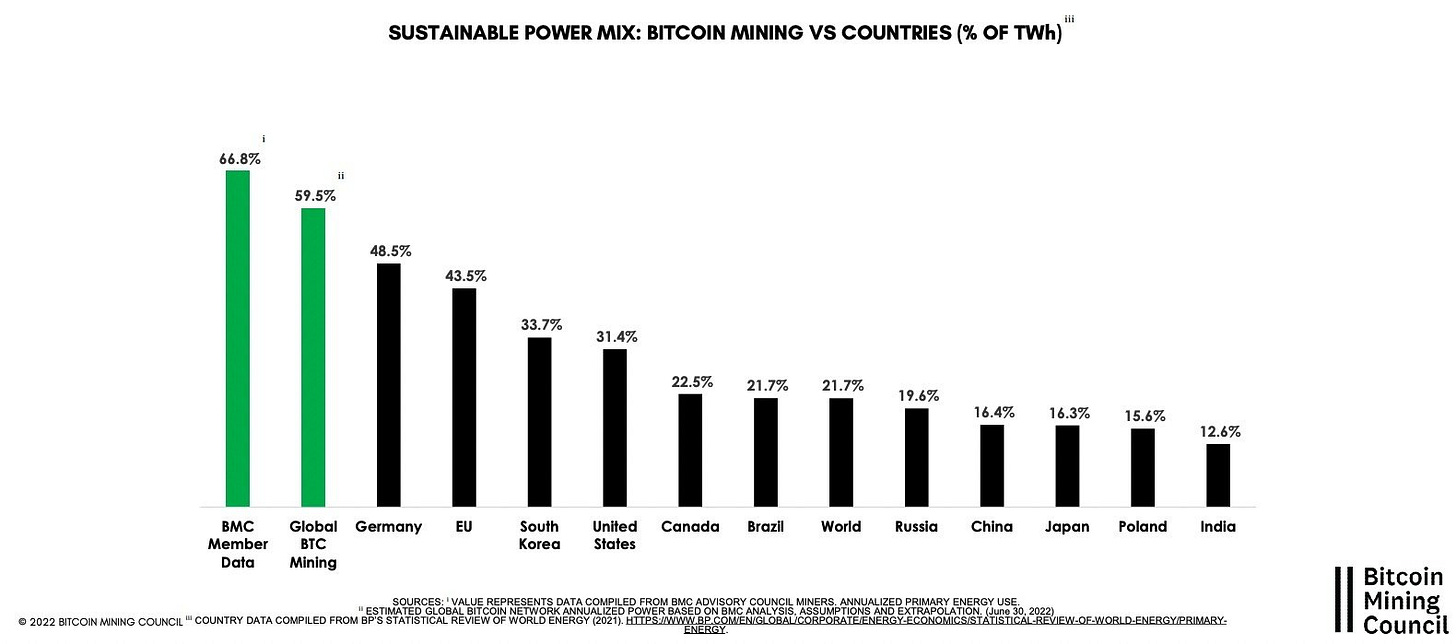

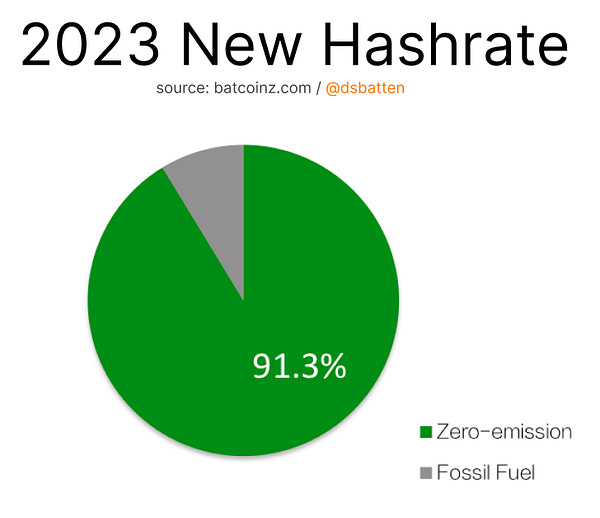

Robust research and matter-of-factuals estimate the global mining network uses between 50% - 70% of sustainable power mixes. This mix far exceeds any other technology/commodity/financial industry, especially against those that also use warehouses of computers for their operations. Due to the Law of Conservation of Energy, we must be realistic and holistic when discussing these sensitive arguments. Headlines that frame BTC as useless and a waste of energy enthusiastically exclaim how the network infrastructure may use more energy than small countries. Is it ok enough if that country has a poor economic output or corrupt governments, but expends most of its energy to export grains? What about if it helps secure an incorruptible bank in cyberspace, completely distributed with the ability to be net carbon negative? After understanding Bitcoin’s use cases, the why, and the how, we can only hope this energy expenditure actually increases. Varied estimates are detailed below:

This reality makes the anti-BTC, pro-“crypto” Proof-of-Stake perspectives disingenuine, as discussed in Part 3. One of the main arguments in favor of Bitcoin’s Proof-of-Work (PoW) mining is that it incentivizes the use of cleaner energy sources. This is because of simple economics. Miners are motivated to minimize their costs in order to maximize their profits, and one of the largest expenses for miners is the energy required to power their operations. As such, miners have a financial incentive to seek out the cheapest and most efficient sources of energy. This has led to the increased adoption of stranded and renewable energy sources such as hydro, solar, and wind power. Some miners have set up operations near hydroelectric dams to take advantage of the cheap and plentiful unused energy supplied by these facilities. Others have turned to geothermal or solar power, which is both renewable and more environmentally friendly than traditional fossil fuels. Some of the largest oil companies in North America have been attaching bitcoin miners to flared gas rigs, which is otherwise wasted physically and energetically. This PoW mechanism can become carbon negative, by not only using up otherwise wasted electrical energy, but converting what would be “dirty” energy into, and securing, freedom technology. By using renewable energy sources, Bitcoin miners help reduce their impact on the environment and play a role in the transition to a more sustainable future. This is not possible with alternative Proof-of-Stake systems of which ~99% of all other cryptos operate, despite it being deceitfully marketed as a better alternative. The Bitcoin Mining Council and Bitcoin Policy Institute are leading efforts to accurately report on data, educate against misconceptions (even those published by governments either purposefully deceitful or outright lazy), and improve educational efforts surrounding this multi-faceted technology. Not only do these methods incentivize optimizing clean energy usage and capture wasted energy, but they also power a humanitarian technology accessible to all. Win-win.

Bitcoin also promotes financial inclusion and empowerment, especially for people who have been excluded from traditional financial systems. It can be used to make cross-border payments more easily and cheaply, which helps people in developing countries access global markets and participate in commerce. Additionally, Bitcoin's decentralized nature means that it is not controlled by any single entity, which has proven to be antifragile and resistant to censorship or interference by corrupted governments or other malicious actors. This can make it a useful tool for people living in countries with unstable currencies or high levels of corruption. There is no bias of gatekeeping, fees, accessibility, or the other detriments that under-served/banked/privileged/property rights communities endure around the world with their own currencies and banking systems’ disadvantages. There is no room for that divisive, subjective, unfair, expensive rule-making/changing or BS in BTC. This is also trending a positive change to promote greater transparency and accountability in the financial system. Additionally, Bitcoin's open-source nature means that its code is publicly available and can be audited and reviewed by anyone, which helps ensure that it is secure and reliable at any point in time. Bitcoin’s characteristics align with the heart of ESG values: increasing environmental sustainability, social inclusion and empowerment, and ethical governance. These factors make it a valuable tool for humanitarian efforts and continue to help improve the lives of all individuals, especially in underserved and disadvantaged communities. More information and details from more intelligent individuals can be found at The Last Word on Bitcoin’s Energy Consumption, The Green Side of Bitcoin, and Why and How Bitcoin Consumes Energy, if interested. The below snippet of Steve Jobs’ interview about the internet poetically illustrates the above:

“It is peaceful yet disrupts the violent military-industrial complex of the petrodollar,” (from Part 1).

The military-industrial complex of the oil-linked dollar refers to the interconnected network of businesses and organizations that produce military equipment and weapons, as well as the financial systems that support them. This system is often described as being driven by the demand for oil, which is traded in US dollars, hence the term "petrodollar”. The military-industrial complex of the petrodollar is harmful to society as it drives the production and use of military equipment, fuel, and weapons, which leads to unnecessary violence, emissions, and endless conflict. This violence has a variety of negative consequences, including loss of life, destruction of infrastructure, displacement of people, displacement of property rights, and untruthful media narratives. Additionally, the demand for oil and the use of the US dollar as the dominant currency for international trade gives the US government and other actors significant control over the oil market and a great deal of economic and political power over other countries. This power dynamic has led to imbalances and injustices, both within the US and globally. Furthermore, the production and use of military equipment and weapons have extremely negative environmental consequences that are conveniently non-existent in corporate media, such as the release of greenhouse gases and other pollutants. Endless fiat with no accountability leads to endless war and crimes against humanity, not to mention the consumerism that led to irreversible environmental effects. Alex Gladstein of the Human Rights Foundation takes a deeper look at The Hidden Costs of the Petrodollar here.

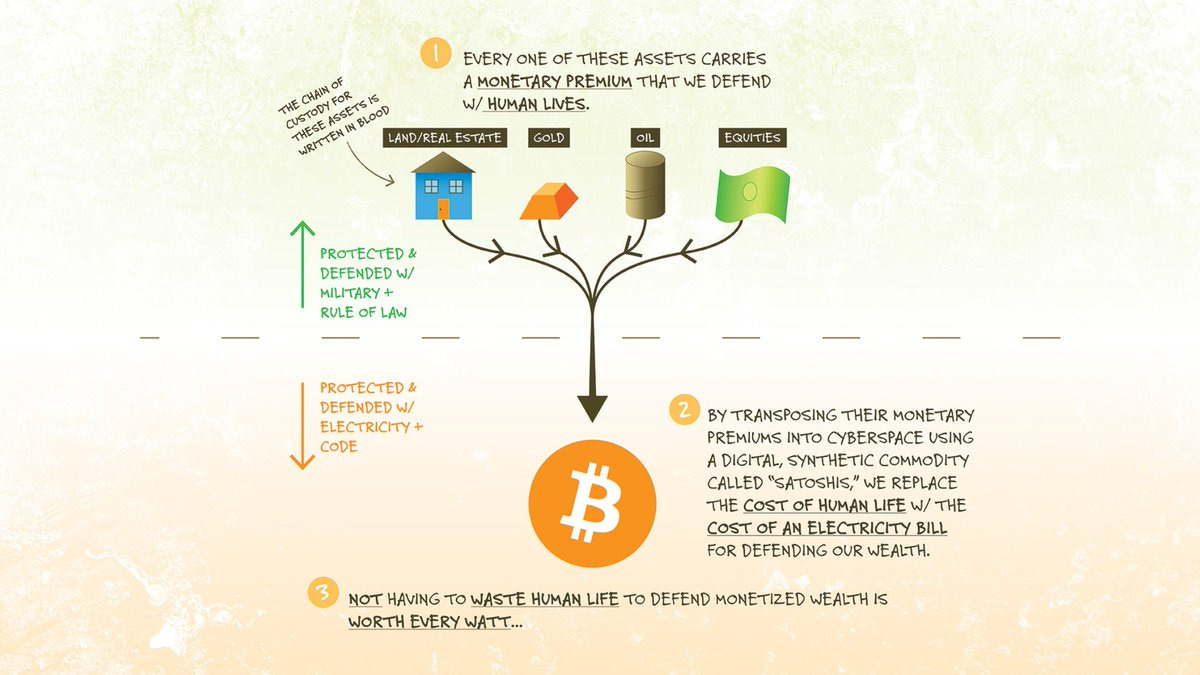

You cannot criticize Bitcoin energy usage, which has a meaningful impact and global need, while turning a blind eye to the existing fiat system. This includes specifics like entertainment-only holiday lights, streaming services, subjectively pointless football gameday flyovers, and the immense amounts of wasted energy previously described above, all of which require energy and happens to not provide an incorruptible bank in cyberspace for all 8 billion people in the world. US National Defense Fellow and MIT grad Jason Lowery perfectly sums up this technological financial transformation from a perspective of physics and first principles:

“It is the antidote to the fiat poison that has exacerbated wealth concentration and squeezed the global middle class for the past 50 years,” (from Part 1).

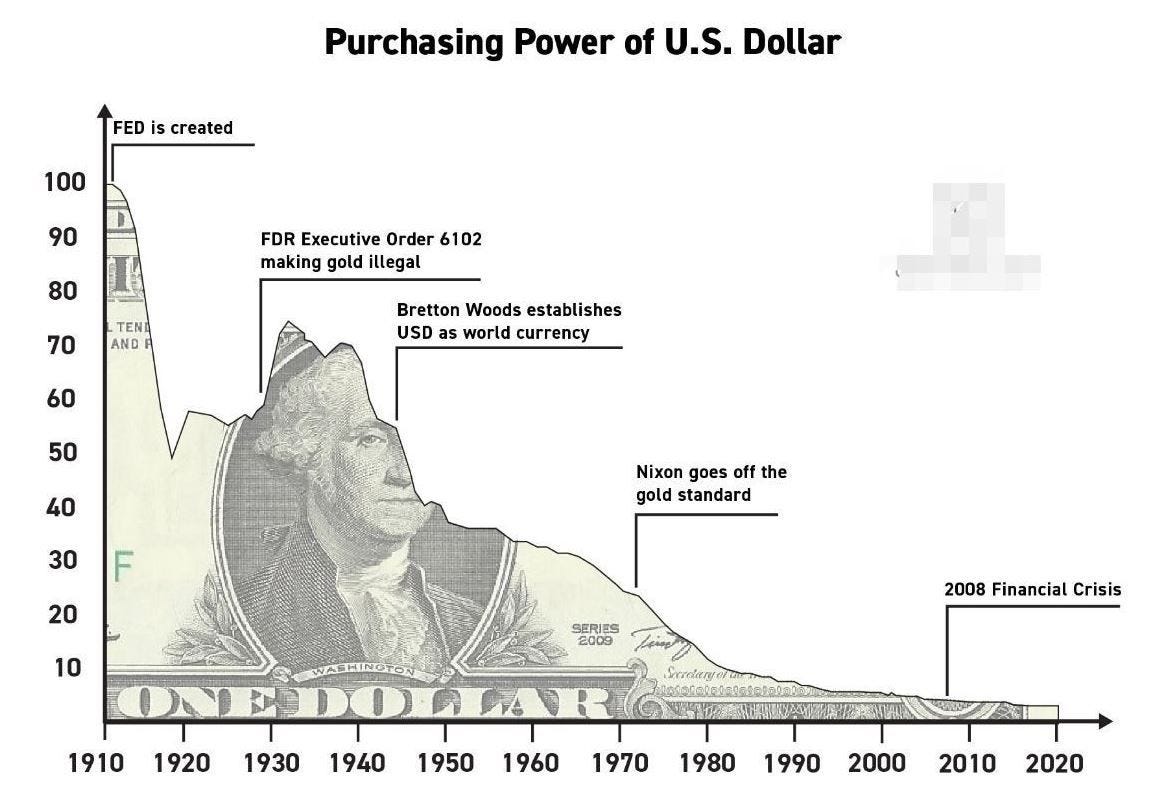

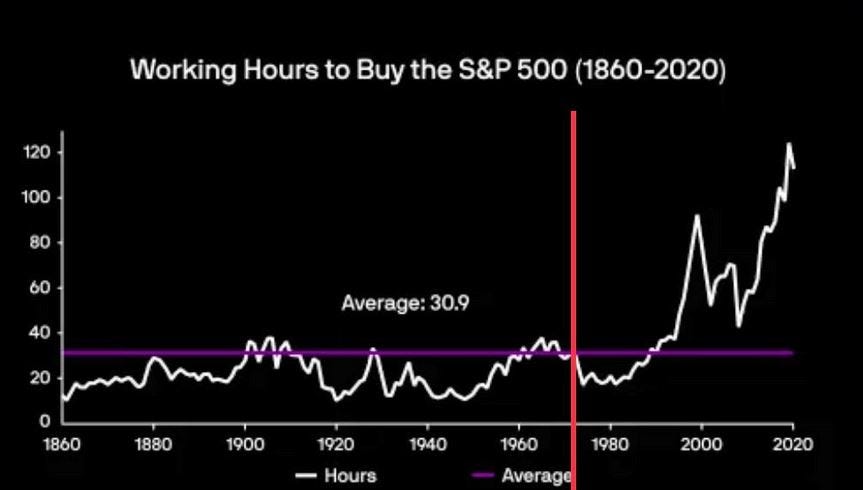

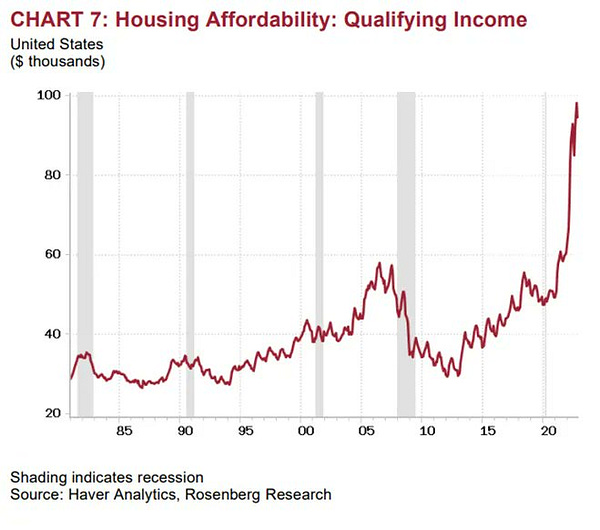

The fiat system refers to the current monetary system in which countries' currencies are not backed by a physical commodity, such as gold, but rather by the government's promise to accept them in payment of taxes. The term “fiat” is Latin for “by decree” or “because I told you so” enforced by “or we take your property and you go to jail”. The intrinsic value of fiat is only as strong as the government backing it, which is only as strong as they willfully impose (or can impose) on others. This system has been in place since 1971 when the US government stopped allowing the redemption of US dollars for physical gold. Since then it has hurt the lower and middle classes worldwide because it has allowed governments and central banks to manipulate the supply of money and credit, which has had a variety of economic consequences for the less fortunate. This practice of monetary expansion has led to sustained inflation and eroded the purchasing power of people's savings and wages all across the globe, and the world reserve currency has not been immune:

It has disproportionately affected people with lower incomes who have a harder time keeping up with rising prices, get penalized for savings, and get forced to invest in risky alternatives to keep up (and that’s assuming they have access to these tools). They are forced to save in the short term for expenses and have virtually no ability to invest and preserve wealth in the long term. Additionally, monetary expansion has led to asset price bubbles which only benefit people who own assets or the “havers”, such as real estate and stocks, but hurt those “savers” who do not own such things, at a compounding scale. This mismatch contributes to a concentration of wealth as those who own assets see their values increase as the denominator of their asset values actually debase in real terms, while those savers fall behind. For the most part, the stock market is just a proxy for net liquidity worldwide, so retirement portfolios can be half-jokingly simplified down to literally depending on further monetary debasement and easy financial conditions. If loose/restrictive monetary policies promote/inhibit growth, then why ever lower/raise federal interest rates anyways? A pseudonymous financial analyst lays out an unapologetic deep-dive of these issues specific to the current system under the US Federal Reserve here:

The fiat system allows governments and central banks to bail out commercial banks and other financial institutions that get into trouble, which causes a moral hazard where these institutions have greater incentive to be risky to acquire profits because they know they will be protected if things go wrong (privatize gains and socialize losses). This type of environment around the world has made it harder for everyday people to access credit, investment accreditation, create businesses, or take advantage of policy loopholes that expensive lawyers, accountants, and lobbying conglomerates essentially gatekeep. Things are extremely different than they used to be:

Source: WTF Happened in 1971?

Overall the existing fiat system has allowed governments and central banks to manipulate the supply of money and credit, varying in depth across the world, which continues to have a variety of economic consequences that disproportionately affect people with lower incomes and personal portfolios no matter their work ethic. Adopting Bitcoin not only helps preserve your wealth from the above grievances, serving as a hedge against corruption and monetary malice, but also helps strengthen a system that is most useful for the most disadvantaged communities worldwide. Voting for BTC via your advocacy/time/value is a vote for sustainable and equitable human rights. A long-form explanation is shown below, but the introductory 5 minutes is a great overview:

So what does this all mean? Learn more in Part 5: A Peaceful (r)Evolution.

In the meantime, increase your Bitcoin knowledge, understanding, and allocation above “0”, aka Get Off Zero.

Disclaimer:

The above content and resources are for educational purposes only and not financial advice. Should you choose to apply the practices described in the above and/or linked content with bitcoin you own now or may purchase in the future, you do so at your own risk and I shall in no event be liable for any financial loss suffered.