Part 3: Bitcoin vs. Crypto

Part 3 of the "Get Off Zero" Series by Michael Bronson

“I missed the boat on Bitcoin, maybe one of these 20,000 other cryptos is the next one.” or “Bitcoin is MySpace and there is a Facebook coming to take its place.”

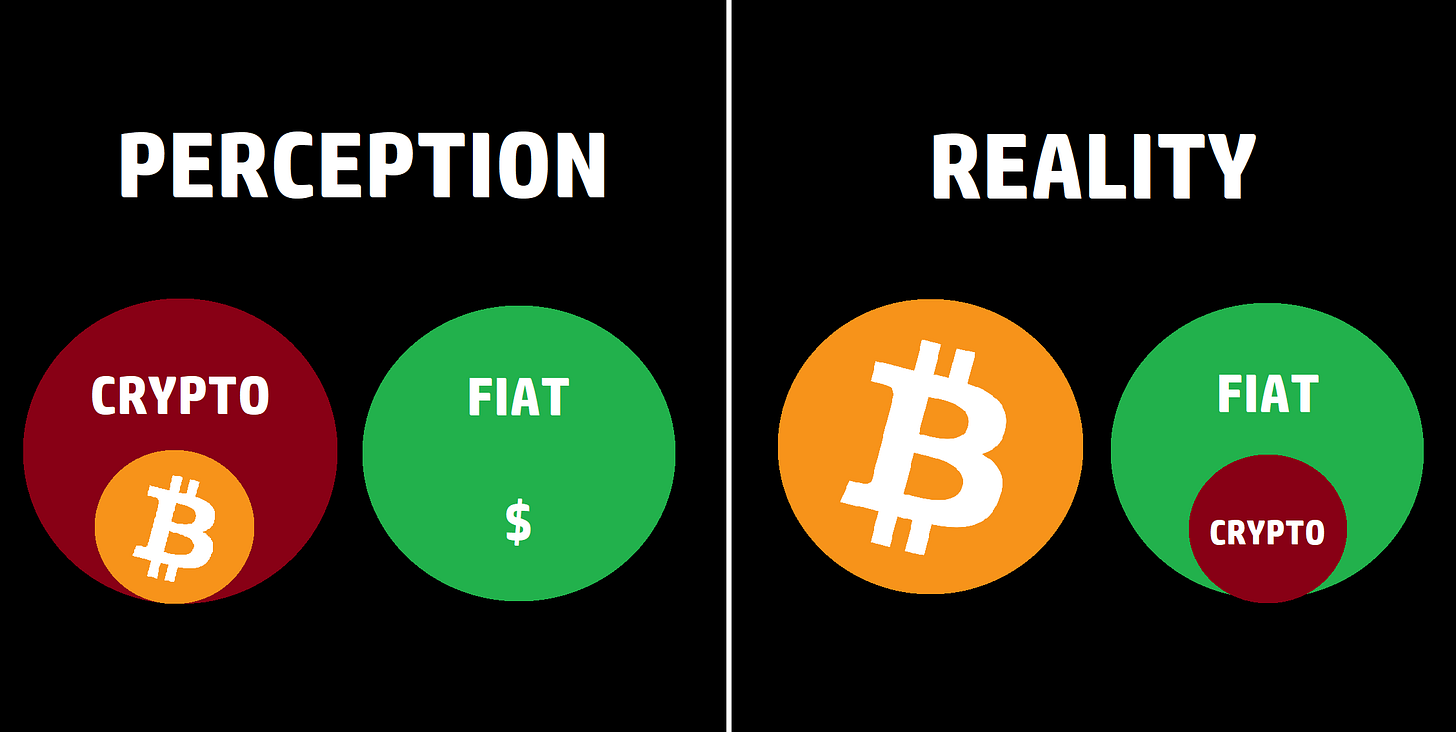

Bitcoin is completely different from the rest and should be considered as its own separate asset class. An uncomfortable fact: 95% of all cryptos since 2019 have evaporated due to a failure of security, governance, and/or malintent partially due to a Wild West regulatory framework affecting gullible retail traders. Unfortunately for these folk, there can never be another immaculate conception of Bitcoin’s genesis block, with no insider pre-mine or venture capital equity, and subsequent technology curve of network effects. BTC was more of a discovery of digital scarcity for the world versus an elementary creation that can be copy-pasted into a trillion-dollar asset. There are many “working” crypto tokens out there but are more of the same as the fiat system, not sufficiently decentralized, and essentially act as tech startups with similar risks to stocks on a greater magnitude. It can be argued that the “Web 3.0” crowd boils down to another marketing gimmick. Sure, there are cool use cases and legitimate functioning projects out there, like any centralized company. However, only Bitcoin, via its incorruptible protocol layer and true decentralization, can separate money from State.

There are several reasons why Bitcoin is considered superior to other cryptos. There have been nearly 30,000 creations of cryptos since 2011, with the first “altcoin” created 2 years after BTC: Litecoin (LTC). LTC was marketed as the silver to BTC’s gold, but with 4x more coin supply, a larger data footprint for maintaining the network, and faster settlement speeds, all of which decreased its security and decentralization. How was that possible? Bitcoin’s software code was published open-source and available for anyone to audit, verify, or tinker with to create their own cryptography coins. LTC was invented by a former Google engineer who sold a majority of their coins at its 2017 all-time high and could not replicate the decentralized network effects of BTC. Other cryptos were purposefully created as a joke or to cash in on the latest viral “thing” (see Squid Game Coin). However, over 99% of them in the history of crypto have failed or were flat-out scams that manipulated retail buyers before pulling the rug out from underneath them.

One of the reasons Bitcoin continues to maintain its superiority is its strong track record and incorruptible history, despite some valiant efforts. The book Blocksize Wars summarizes the debate from 2017 when large players wanted to change its code via consensus for larger block sizes and scalability fees (like in the fiat system where they can change the rules to benefit the few), subsequently reducing its decentralization and security, had lost to the decentralized network of validating-users, or nodes. This effort failed despite large centralized funding, smear campaigns, and other methods that are usually easy to implement when the majority of capital attempts to change something in today’s day and age. But not with Bitcoin. Despite efforts from large industry players, like CEOs and mining companies, to implement a code upgrade to increase block sizes, the “capital minority” group of nodes prevailed with consensus to maintain the BTC network, as is, with its original block size algorithm. As a result, there was a community of backers that hard-forked a new, separate blockchain of this increased-block-size-“bitcoin” dubbed Bitcoin Cash (BCH). The market clearly chose the winner, as BCH is down 97% from its all-time high in 2017 and failed to make a new high in 2021, unlike BTC, which 3.5x’d its price from the 2017 peak and still remains more valuable at today’s prices, even despite the recent bear market and crypto industry contagion. There were and will be many more attempts at “creating a new, better Bitcoin” or even, again, at changing its existing protocol code that we’ll explore later on. Bitcoin’s discovery, longevity, immaculate inception, antifragility, and widespread adoption have given it a level of credibility that other cryptos can never achieve. The past decade of cryptocurrency market cap performance is highlighted below:

The Lightning Network:

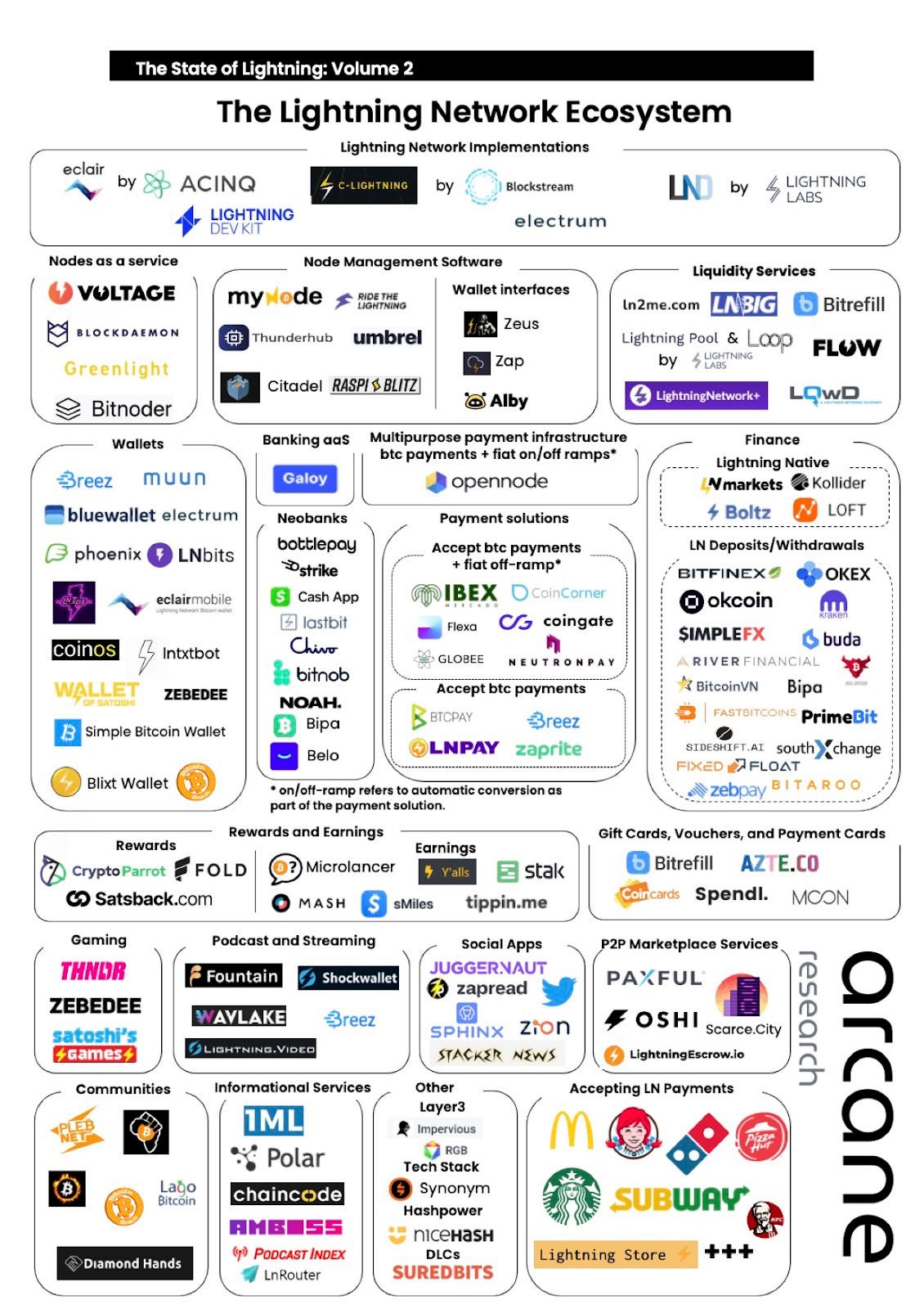

An additional beauty of its technology is the ability to layer on top of its base protocol, like the internet, and increasingly obsoletes competing altcoins. After all, Bitcoin is more than just money; it is a software protocol that enables layers of systems to be built upon vertically. For example, the Lightning Network (LN) is a Layer 2 protocol that allows for faster, cheaper, and more scalable transactions on top of the Bitcoin base layer. It works by creating off-chain channels between two parties, allowing them to make multiple transactions without the need to record each one on the base blockchain. This is almost like keeping tabs with your friend or roommate sharing expenses throughout the month, then settling up at the end instead of daily Venmo transactions back and forth that end up zeroing out anyways. This method reduces transaction fees and speeds up the process, making it more time efficient than Layer 1’s on-chain transactions. One of the main advantages of the Lightning Network is its scalability. It can handle a large volume of transactions without putting strain on the underlying Layer 1, making it a viable solution for increasing the capacity of the Bitcoin network to satisfy the demand for exchanging value at any given time in any given amount, even 1 satoshi which is 1/100,000,000th of a BTC (~$0.00023), seamlessly. The Lightning Network allows for these microtransactions, which are small transactions that are not as economically feasible on the main chain. This enables more efficient uses of Bitcoin for everyday purchases, like a cup of coffee versus monthly rent, and opens new use cases for the multifaceted asset. In comparison to other Layer 2 cryptos, the Lightning Network has several advantages. It is built on top of the most secure blockchain infrastructure and has a large, active developer community which helps to ensure its ongoing development and improvement. Additionally, the LN has seen widespread adoption by holder, consumer, and merchant infrastructure worldwide that continuously strengthens the ecosystem:

Slowly but surely the LN will continue to emerge as a superior payment alternative with the use of QR codes, email-like addresses, value-for-value streaming, and tap-to-pay tech as seen below:

It is a superior choice for a Layer 2 payment protocol due to its scalability, ability to handle microtransactions, strong security, and widespread adoption. These factors make it a reliable and efficient solution for increasing the capacity and use of the Bitcoin network and help make Bitcoin more convenient and easier to use. LN has accelerated the superiority of BTC, rendered other crypto projects inferior, and is threatening Visa’s stronghold on micro-payments. Even then, Visa is a Layer 3 on top of the base layer of fiat currencies and does not provide final settlement until 90+ days after transacting (think credit card disputes). Check out a visualization of its throughput capacity compared with alternatives for transactions per second below:

Proof-of-Work (PoW) vs. Proof-of-Stake (PoS):

The mechanism to generate and validate blocks for cryptos has become an increasingly debated topic. Proof-of-Work refers to expending real-world energy, like mining gold. Proof-of-Stake refers to the largest holders or stakers being rewarded to generate transactions and control the protocol, like fiat. Bitcoin’s use of Proof-of-Work and a decentralized network of miners makes it resistant to censorship and fraud. It also has a strong track record of handling large volumes of transactions without any major issues. Other attempts to make “greener” crypto using Proof-of-Stake governance have failed due to sacrificing the security and censorship-resistant properties of why Bitcoin was created in the first place, to be an equitable alternative to the existing fiat Proof-of-Stake system. One of the main advantages of PoW is its security. PoW requires miners to expend computing power in order to compete with eachother, similar to a lottery odds, with the honor to mine that block of transactions and add new blocks to its timechain of blocks. Miners are incentivized by block subsidies which are rewarded in BTC. River Financial succinctly explains this below:

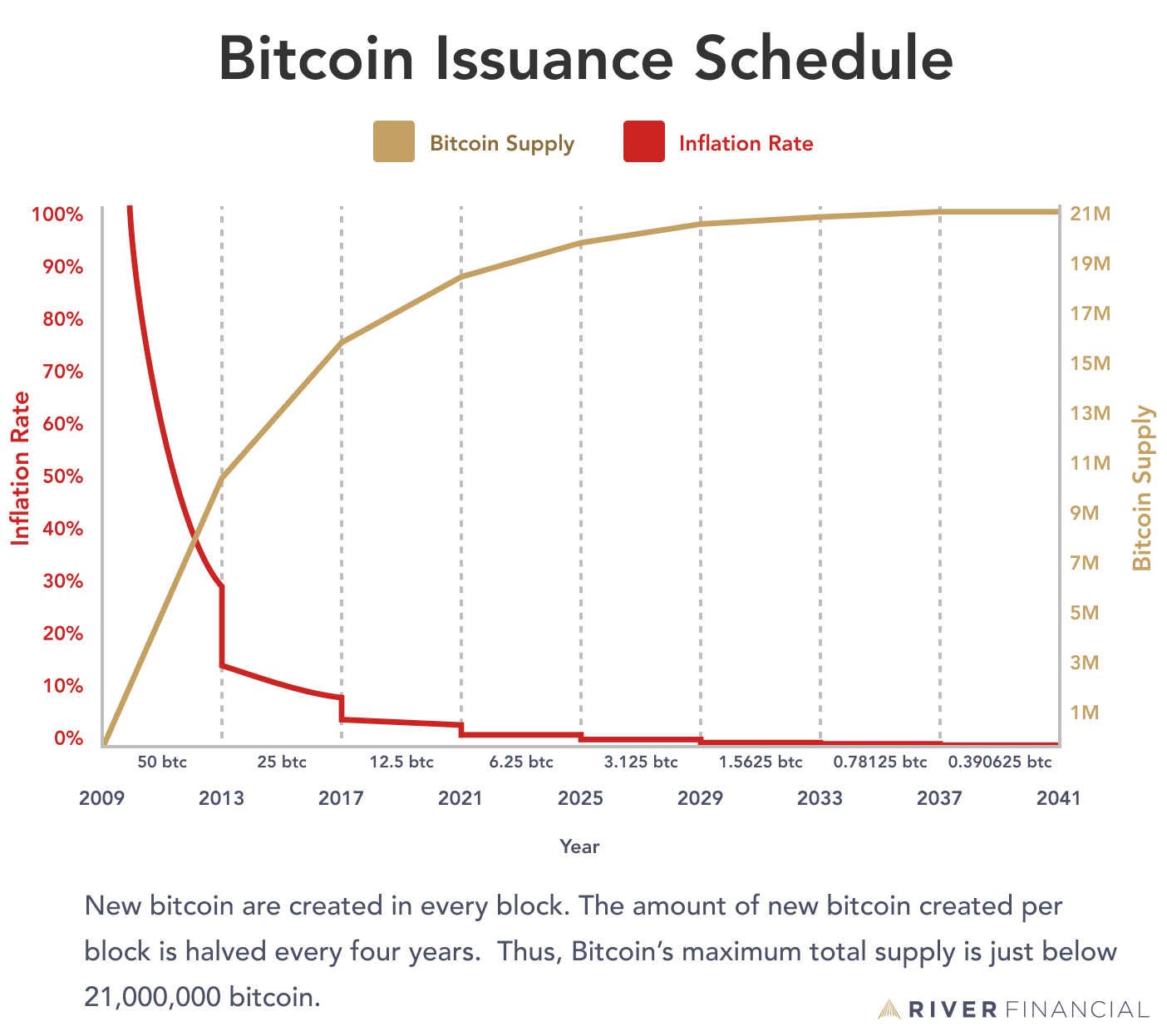

“The block subsidy is the amount of new bitcoin minted in each block. Each block that is produced and added to the blockchain allows the creator of the block to mint a certain amount of new bitcoin. This amount is strictly determined by an algorithm in Bitcoin’s source code: the subsidy started at 50 BTC per block, and is cut in half every 210,000 blocks or roughly 4 years. The block subsidy is how new bitcoin enters into circulation, but it also incentivizes miners to remain honest and submit valid blocks. The block subsidy is paid out in the coinbase (initial) transaction of each block. This special transaction is the first transaction in every block, and it has no inputs. The output of a coinbase transaction cannot be spent for 100 blocks, so miners can only spend their block subsidy after a 100-block cooldown. Each block contains many transactions, each with fees attached to incentivize their confirmation. The sum of the block subsidy and cumulative transaction fees in a block yields the block reward. Because the block subsidy falls by half every four years, transaction fees will slowly begin to make up most and then all of the block reward.”

This process, known as mining, requires real-world energy and resources, unlike PoS or fiat, which attaches a cost of energy to generate or expend BTC and creates friction for spam-like activity. This serves as a deterrent to malicious actors, who would need to expend a large number of resources in order to even attempt to compromise the network, which is virtually impossible due to further technical brilliance like the difficulty adjustment, explained by River Financial below:

“The difficulty is a measure of how hard it is to mine a block. In order to mine a block, miners must provide Proof-of-Work in the form of a valid hash of the block they intend to publish. A hash is essentially a large number, and for a hash to be valid, it must be smaller than a defined target number. This target number determines the difficulty of mining and is set by Bitcoin’s ruleset. This difficulty is dynamic: it updates every 2,016 blocks—roughly 2 weeks—to ensure Bitcoin blocks come in roughly every 10 minutes. If more miners join the network and mine blocks at a faster rate, the difficulty will rise. If miners stop mining, and blocks arrive slower than every 10 minutes, the difficulty will fall. The difficulty therefore directly follows the trend in the hash rate of the network. In a technical sense, the Bitcoin network sets the target rather than the difficulty. All valid Proofs-of-Work must be below this target. The difficulty then is simply the inverse of the target. If the target is raised, this makes it easier for miners to find a hash below the target, so the difficulty has been lowered. Likewise, if the target is lowered, the difficulty has been raised. The target is encoded as a part of each block header and is called the ‘bits’ of a block. This allows nodes to directly verify whether the Proof-of-Work provided for a block is lower than the target.”

Bitcoin and its PoW mechanism connect the real world of physics and thermodynamics to the digital world of an encrypted bank in cyberspace. In contrast, PoS crypto projects do not require miners to perform any work, which means that they can print out of thin air, centralize to change the rules and monetary policies on a whim, are more vulnerable to exploitative attacks, have no connection to the real world, and effectively act as a video game play currency or fiat-like Monopoly money. To date, ~92% of all bitcoin that will ever exist (21,000,000) have been mined or generated only 14 years after the genesis block. What is even more fascinating is that the remaining ~8% will occur over the next ~120 years, due to the transparent, math-backed, decentralized node-validated, deflationary supply schedule software coded into the protocol’s algorithm back in 2008:

Bitcoin has a fair mechanism of fixed supply policies that will remain inelastic and understood through decentralized consensus, unlike any other asset, fiat derivative, PoS crypto, precious metal, or stock. Anyone can mine with PoW. Another advantage of PoW is its decentralization. Because PoW requires miners to expend resources in order to participate in the network, it allows for a more distributed network compared to other crypto PoS systems, which often require users to hold a certain amount of tokens in order to participate in block validation. This can lead to the concentration of power in the hands of a few large token holders, as seen in the 2nd largest crypto, which compromises the centralization and ethical security of the network, and is susceptible to changing the rules to benefit the largest holders. Even so, some of these staked tokens have no withdrawal mechanisms in place for their validators, which is unstable and unethical for a supposed monetary alternative. There are 30,000+ public mining nodes and hundreds of thousands of verifying nodes in total across the Bitcoin network that secure it and are incorruptible to tactics used for PoS alternatives. A deeper dive can be found below:

Bitcoin and its PoW mechanism have immutable security and have been used for over a decade, making it a proven and reliable consensus mechanism. In contrast, PoS crypto tokens are not sufficiently decentralized, corruptible, and unstable, which raises concerns about their long-term security and viability as a sound financial instrument. PoS cryptos are essentially company stocks or digital fiat, with the power to change the rules, issue more shares, or alter the game left for the largest holders or stakers whenever they see fit.

Outside of tinkering with and forking the original code to create new altcoins, there are still efforts today that campaign to change its existing code in the name and falsehoods of ESG (Environmental, Social, and Governance) narratives. For example, Greenpeace USA has thrown money down the drain in a marketing effort this past year (funded by an altcoin founder under SEC investigation) to “Change The Code” to Proof-of-Stake, despite the countless debunked myths and tradeoffs of Proof-of-Work energy usage.

“Proof-of-Work is based on a positive or reward-based incentive system, and Proof-of-Stake is a negative or penalty-based incentive system, where the validators do no actual work, and need to be careful to never misbehave.” - Scott Sullivan

In addition, the Chairman of the US Securities and Exchange Commission, Gary Gensler, recently opined that “everything other than Bitcoin” could be considered a “security,” and should be treated regulatory-wise and risk-wise like tech stocks:

Bitcoin, backed by its PoW framework, is a separate, new, emerging type of asset class. It is superior to alternatives and great for the planet. We’ll explore a detailed explanation as to why in Part 4: The Humanitarian Case for Bitcoin, which is my personal favorite section exemplifying why I am so passionate about BTC.

In the meantime, increase your Bitcoin knowledge, understanding, and allocation above “0”, aka Get Off Zero.

Disclaimer:

The above content and resources are for educational purposes only and not financial advice. Should you choose to apply the practices described in the above and/or linked content with bitcoin you own now or may purchase in the future, you do so at your own risk and I shall in no event be liable for any financial loss suffered.