How to Jumpstart Your Financial Journey

Simple Tips for Overcoming the First Hurdle of Personal Finance

Managing our wealth is essential to secure a stable financial future and strengthen our well-being. There seems to be a disconnect among late Millenials and Gen Z’ers who delay or avoid this personal responsibility, which is arguably the only thing we can control among a world of uncontrollables. With all the nonsense that's been happening, it's no wonder why many of us feel stuck and anxious when it comes to our finances. It’s easy to feel like you’re drowning in financial stress after coming off the heels of a pandemic, fluctuations in the job market, and soaring inflation. However, every day that goes by while procrastinating can set us back months, even years. The best time to start was yesterday, but it’s never too late. I’m here to help you navigate and get started with some simple yet effective tips for jumpstarting your personal wealth management journey. This first hurdle can feel like daunting homework, but your future self is the teacher and will extremely appreciate it. Whether you're itching for a weekend getaway, paying off student loans, or saving for a house, this step-by-step guide will help lead you to a healthier financial outlook.

Start With Your Goals

Setting clear and achievable financial goals is imperative for effectively managing your finances. Without goals at the foundation, it can be challenging to focus and make informed decisions, and you may find yourself feeling directionless or even discouraged. That discouragement can compound into a deeper hole that becomes harder to dig out of. Turning it around, putting one foot in front of the other, and taking this first step will break the ice toward a brighter future. Setting SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals is crucial for effective personal wealth management. Here are some key points to consider when setting your financial goals:

Specific:

When you set specific goals, you have a clear idea of what you want to achieve. This helps you focus on what matters most, and avoid distractions that may lead you off course. For example, rather than saying "I want to save money," you should instead think “I want to accumulate $10,000 in savings by this time next year.”

Measurable:

A goal that is measurable allows you to track your progress and see how well you are doing. This helps you stay motivated and adjust your strategies if necessary. Setting a specific amount, like the $10,000 from above, can be measured against monthly chunks (~$833) to stay on track.

Achievable:

It's important to set goals that are realistic and achievable. While it's great to aim high, setting unrealistic goals can be demotivating and may even hinder your progress. If you earn $50,000 a year, it may not be feasible to save a target of $50,000 in that first year. This helps you avoid setting yourself up for failure, and instead gives you a sense of accomplishment as you make progress towards your goal.

Relevant:

Your goals should be relevant to your overall financial plan and your current situation. This ensures that your efforts are directed towards something that truly matters to you and your financial well-being. Someone who has six figures of student debt may want to hold off on purchasing a fancy new car first. These can also include saving for a down payment on a house or investing for retirement. Long-term goals require planning and patience, but they are achievable with a clear plan, a disciplined approach, and consistent effort.

Time-bound:

Setting a deadline for your goals gives you a sense of urgency and helps you stay focused. It also allows you to break down your goals into smaller, manageable steps, which can make it feel less intimidating and more achievable. For example, that $833 per month amount can be dilligently tracked down to ~$200 a week or ~$27 a day where you might otherwise be spending on non-essentials.

Using this SMART method helps you stay focused, motivated, and accountable. To get started, take some time to reflect on what's important to you and what you hope to achieve in the short-term (like 1 year) and long-term (say 5 years). Write down your goals and be as specific as possible. Consider how much money you'll need and how long it will take to achieve each goal. With prices fluctuating and market uncertainty, it is always better to round up and later become pleasantly surprised.

Once you have your goals in mind, create a plan to achieve them. Break down your goals into smaller steps and create a timeline for each step. For example, if you are dissecting a short-term goal 1 year from now, revisiting this week by week will be more digestible than broadly month by month. The weekly approach of checking in can better capture variables and adjust to changes in your routine. Celebrate your achievements along the way to stay motivated and committed by positive reinforcement. It may not feel like much at the time, but your future self will thank you.

By setting clear and achievable financial goals, you'll have an outline for managing your personal finances effectively. It may take some time and effort to achieve, but with a clear plan and consistent effort, you can take control of your finances and work towards a more stable future. Getting over this first hurdle will lead to much less anxiety. Don’t just trust my word for it, verify it yourself!

Create A Budget

Creating a budget is an essential step in managing your finances. It can help you understand: where your money is coming from, where it is going, and how to optimize both towards your goals. Budgeting provides a clear roadmap and helps you make informed decisions about adjusting your spending habits. Here are some key points to consider when creating a budget:

Use a spreadsheet or a budgeting app to create a budget.

There are many free resources available that can help you create a budget, such as your banking provider, Google Sheets or Mint.com. Research, choose a tool that works for you, and input your income and expenses.

Categorize your past expenses.

Your bank account should have a readable (or better yet a downloadable) list of transactions that can be easily backtested. Divide your expenses into categories such as housing, transportation, food, entertainment, savings, and investments. This will help you see where you're spending the most money and where you can make adjustments. This step can be both alarming and motivating to change your

drinkinghabits.

Adjust for the future and start with the essentials:

Make a list of your essential fixed expenses, aka “needs”, such as rent, utilities, groceries, and transportation costs. These are expenses that are necessary for your basic cost of living. By starting with the essentials, you can ensure that your needs are met before allocating money for discretionary spending, aka “wants”. Needs > Wants.

Set aside money for savings:

Make savings a priority in your budget, no matter how large or small after the above essentials. Set aside a portion of your income for emergencies, retirement, and other financial goals. We will go into more detail here later on.

Be realistic and limit yourself:

It's important to be honest with yourself about your spending habits when creating a budget. Acknowledge areas where you tend to overspend and make a plan to address them, such as by setting a spending limit or finding alternatives and other ways to cut back.

Efficient automation:

If you're saving for a specific goal, consider automating these cashflows. Just like subscription expenses, reverse-Uno-card to pay yourself. Set up automatic transfers from your checking account to your savings and investment accounts each month to ensure that you're consistently making progress toward these goals.

Review and adjust your budget regularly:

Your income and expenses may change over time, so it's important to review your budget regularly and make adjustments as needed. You can take a lump sum of monthly amounts and divvy them up by weeks and days to ensure you’re on track. Be sure to leave some wiggle room for unexpected expenses, like price increases or other emergencies. If you're consistently overspending in a particular category, you may need to reevaluate your spending habits or find alternatives. The late night weekend warrior in you may need to retire…

In summary, creating a budget is an essential step in managing personal finances. It helps you gain control of your money, provides a clear picture of your spending habits, and allows you to prioritize your spending and savings goals. With a little bit of effort, discipline, and consistency, you can take control of your life and work towards a more stable financial future.

Assess Your Debts and Credit Score

Assessing what you owe and your creditworthiness is also an important step in adjusting a budget and managing your money. Contrary to traditional talking points of “never go into debt,” or “buy everything with cash,” we actually need to take on debt, like loans and credit card balances, to improve credit worthiness and enjoy better treatment with financing down the road (car, house, etc.). The wealthiest individuals and companies take on some debt to utilize its advantages at growing wealth more efficiently. Here are some tips to keep in mind:

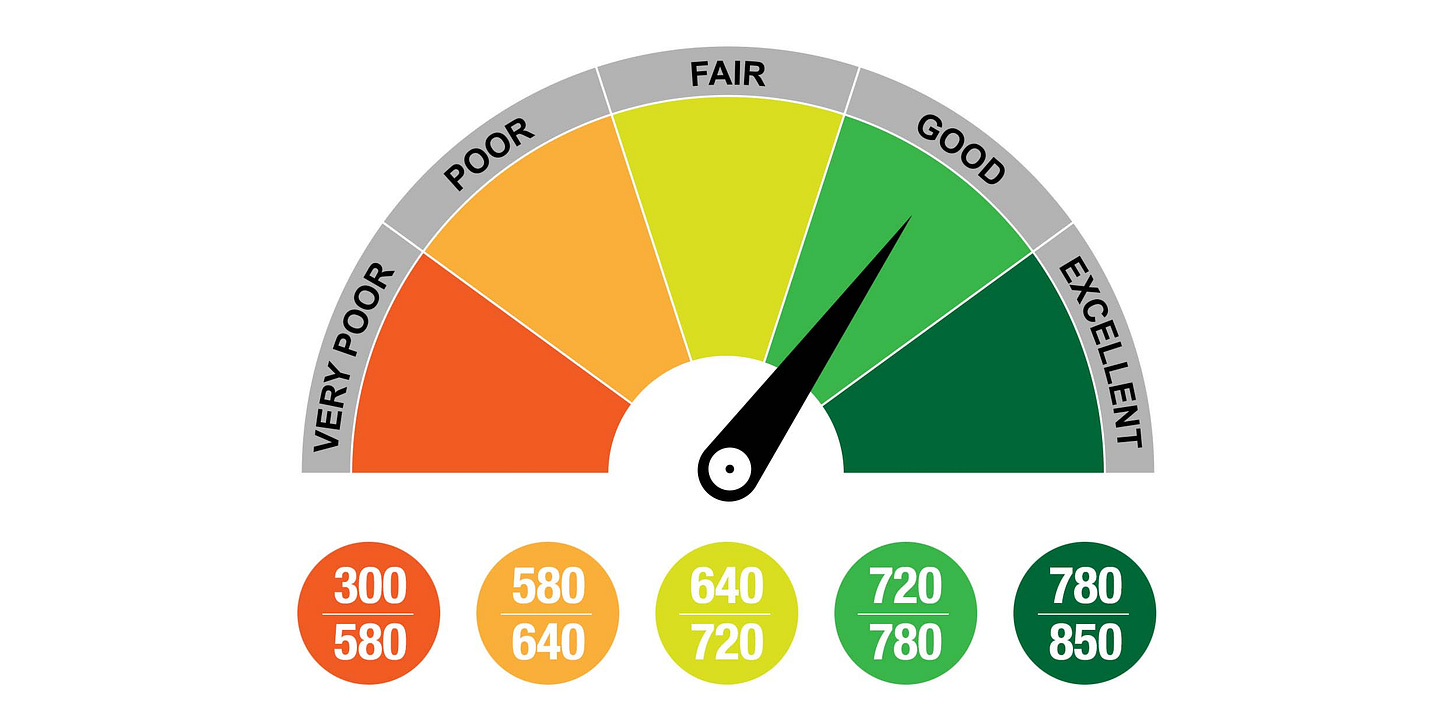

Understand your debts and credit score:

This includes knowing how much you owe, to whom, and at what interest rates. Understanding your credit score is also important, as it can impact your ability to borrow money and access credit in the future.

Obtain your credit reports and scores:

You can obtain your credit reports from the three major credit bureaus: Equifax, Experian, and TransUnion, for free once a year. Reviewing your credit reports can help you identify any errors or inaccuracies that may be affecting your credit score. It is important to track these changes as mistakes are possible, and leaving those inaccuracies uncorrected can have detrimental impacts down the road.

Prioritize high-interest debt:

If you have multiple debts, it's important to prioritize paying off those with the highest interest rates first. This can help you save money in the long run by reducing the amount of interest you end up paying in whole. For example, if you are backed up on credit card debt and car payments, interest rates on credit cards are ~4x greater on average and should be tackled with priority.

Consider debt consolidation or refinancing options:

If you have multiple debts with high interest rates, you may want to consider consolidating them into a single loan with a lower interest rate. Refinancing options may also be available for high-interest loans or credit cards.

Make payments on time:

Making payments on time is crucial for improving your credit score. Late payments can have a negative impact on your credit, so it's important to make payments on time or set up automatic payments to ensure that you don't miss any. I personally create calendar events for due dates and verify those payments, especially on paydays.

Assessing your debts and credit is an important step in managing your wealth. By understanding your debts and credit score, obtaining your credit reports and scores, prioritizing high-interest debt, considering debt consolidation or refinancing options, and making payments on time, you can work towards improving your credit worthiness and achieving your financial goals.

Start Saving

With less than 50% of U.S. adults saying they could cover a $1,000 emergency expense, it’s important to expect the unexpected. Some key points are below:

Saving for emergencies and long-term goals:

The first reason to save is to create an emergency fund. Unexpected expenses can occur at any time, such as car repairs or medical bills. Saving for emergencies ensures that you have a cushion to fall back on during tough times. Another reason to save is to plan for long-term financial goals, such as buying a home, paying for college, or retirement.

Start small and work your way up:

Many people find that saving a set amount each week or month is a good way to build up their savings without overwhelming their budget. For example, you could start by saving 5% of your income and gradually increase that amount as you become more comfortable with saving. It can seem intimidating at first, but starting somewhere with any amount is better than continuing to procrastinate.

Tips for saving:

One strategy is to set up automatic transfers from your checking account to your savings account. This way, you won't have to remember to transfer money manually, and you'll be more likely to stick to your savings plan. Another option is to use a high-yield savings account, which typically pays higher interest rates than traditional savings accounts. This can help your money grow faster and provide you with more financial flexibility.

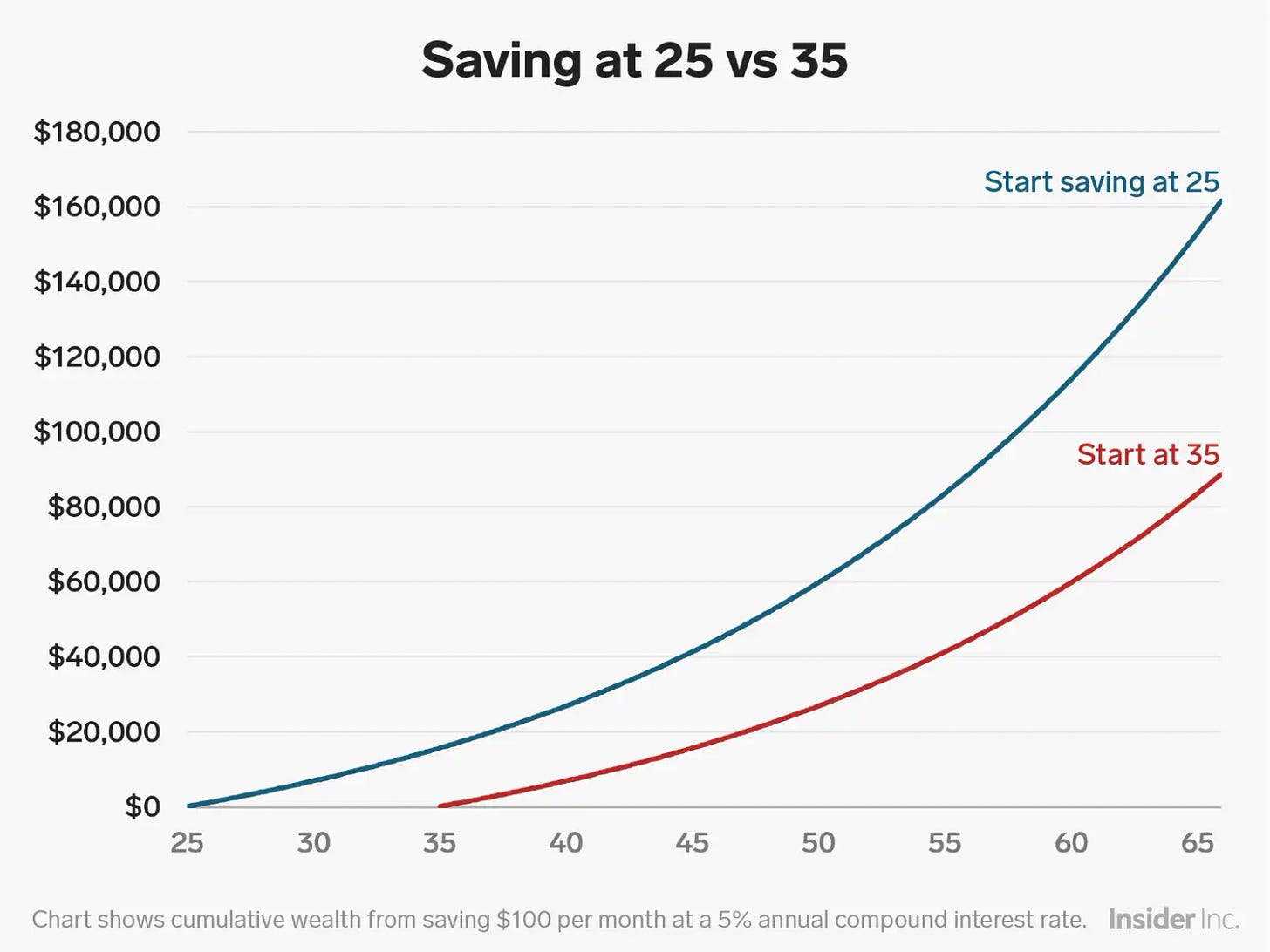

Take advantage of employer-sponsored retirement plans:

Finally, it's essential to take advantage of employer-sponsored retirement plans, such as 401(k) plans. These plans often offer matching contributions from your employer, which can help you save even more money over time. By contributing to a retirement plan early on, you can take advantage of compound interest and ensure that you have enough money saved for retirement. Employer matching programs are literally free money, and it is recommended to set aside up to their matching threshold at a minimum.

By following the above tips and starting to save, you can build a solid financial foundation, sleep better at night, and progress towards achieving your goals.

Invest For The Future

Investing is a critical aspect of personal wealth management, especially when it comes to long-term goals. By investing, you can grow your money faster than you would by simply saving, allowing you to reach your goals more quickly. Here are some considerations to keep in mind:

Importance of investing for long-term financial goals:

Investing is essential for achieving long-term financial goals, such as retirement planning, saving for a down payment on a house, or building wealth for future generations. By investing, you can take advantage of compound interest and potentially earn higher returns than you would with traditional savings accounts.

Start investing early and regularly:

Starting to invest early is one of the most important things you can do to ensure long-term success. The earlier you start investing, the more time your money has to grow. It's also essential to invest regularly, even if it's just a small amount each month, to take advantage of compound interest and stay on track with your financial goals. You don’t have to be a stock trader or technical analyst with price charts across three screens. As the saying goes, “time in the market is better than timing the market.”

Tips for investing:

One strategy is to diversify your investments, which means spreading your money across different types of investment buckets, such as stocks, bonds, bitcoin, real estate, commodities, and mutual funds. This can help reduce your overall risk and potentially increase your returns. It's also important to consider your risk tolerance, or how much risk you're willing to take on in your investments. The higher the risk = higher volatilty or potential returns, and vice-versa. This will help you choose investments that align with your goals and comfort level. Risk tolerances typically decrease over time as you near retirement, but can also change depending on your goals, life stages, and family situations. Finally, if you're not comfortable managing your investments on your own, it may be helpful to seek professional advice from a financial advisor. It is estimated that 90% of the most educated do-it-yourself stock traders fail to beat the market, so it is statistically better to hold index funds and partner with professionals.

Investing is a crucial component of personal wealth management. By investing for long-term financial goals, starting early and regularly, and following tips such as diversifying investments, considering risk tolerance, and seeking professional advice, you can build a solid investment portfolio and achieve your financial goals over time.

The Bottom Line

Caring about your money is important now more than ever. Personal wealth management can seem overwhelming, but is important for securing stability and sustained mental well-being. The consequences of delaying these actions will be felt more severely down the road, so do your future self a favor and start today. Using the SMART method can help with staying focused and accountable as you work towards achieving your financial goals. Be proactive with reviewing your plan, adjusting your budget, building creditworthiness, saving, and investing (no matter how big or small). Controlling what’s in our control now will enable us to effectively manage uncontrollables when they arise. The above tips provide a roadmap to invest in yourself and jumpstart a seemingly complex lifelong project in a simple way. Money cannot buy happiness, but proactively managing your finances can buy time and peace of mind later on.

Thanks for reading!

Disclaimer:

The above content and resources are for educational purposes only. Should you choose to apply the practices described in the above and/or linked content, you do so at your own risk and I shall in no event be liable for any financial loss suffered. It is highly recommended to seek professional advice from a licensed advisor before making any investment decisions.