Invest in Yourself: How to Prepare for Financial Uncertainty

TBT! This article was written nearly 4 years ago while I was attending Northeastern. Although macro conditions have drastically changed since, the message remains more pertinent than ever.

Originally published HERE

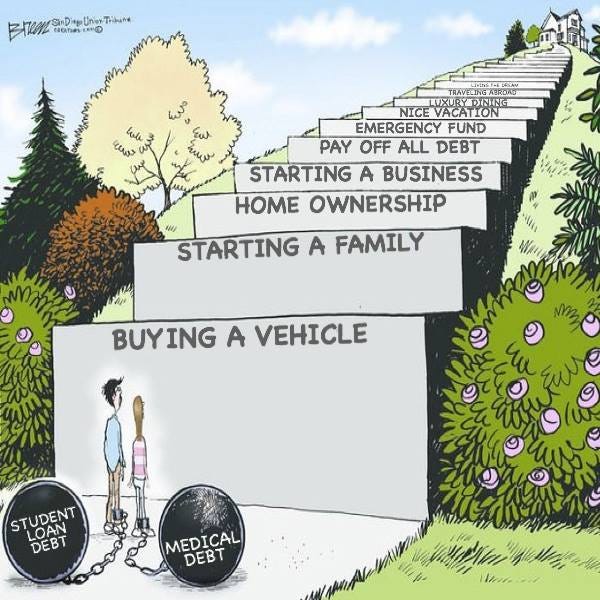

Financial well-being is a holistic concept of financial and mental wealth. Money can’t buy happiness, but it can grow time and peace of mind. It is difficult for young adults to implement responsible financial decision-making habits without any guidance or learned experience. Combined with the increasing wealth disparity among the middle-class, astronomical student loan debt, and future uncertainty, it is important to take control of our own money management and operate as a business. Financial well-being, independence, freedom, whichever phrase encompasses your connotation of peace of mind, is unattainable without a conscious effort towards sustainable growth and life goals. It is easier said than done, but discussions will spark action. Analysis of discourse communities like Finance Twitter (FinTwit), showcase their usefulness for collaborative dialogue and can help people work towards financial well-being. We must help build each other up to foster financially healthy communities. External forces help, but sustained perspective comes from within, especially in today’s environment of uphill struggle toward financial well-being that applies to almost everyone.

Current Economic Snapshot:

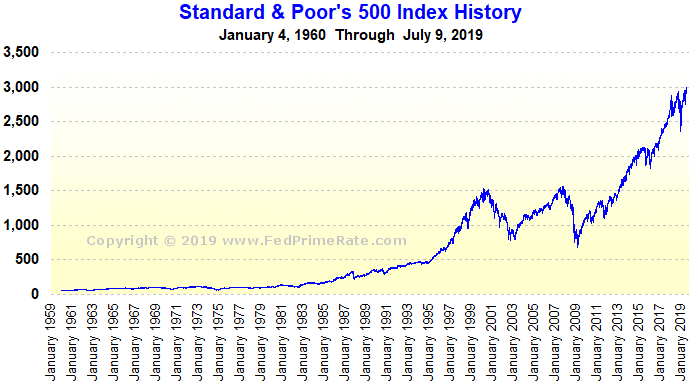

The stock market is a hot topic that some people, unfortunately, choose not to understand. There is no need to learn technical aspects, but a basic understanding of the overall scope of the economy is helpful to contextualize current events and better position ourselves for success. The chart below of the S&P500, or the wealthiest public companies in the US stock market, should contextualize the current market economy:

The market is at all-time highs, and its impressive recovery since the 2008 financial crisis can only extend so far. How far? No one can be certain, but we must prepare for uncertainty.

“The bigger they are the harder they fall...” — Anonymous

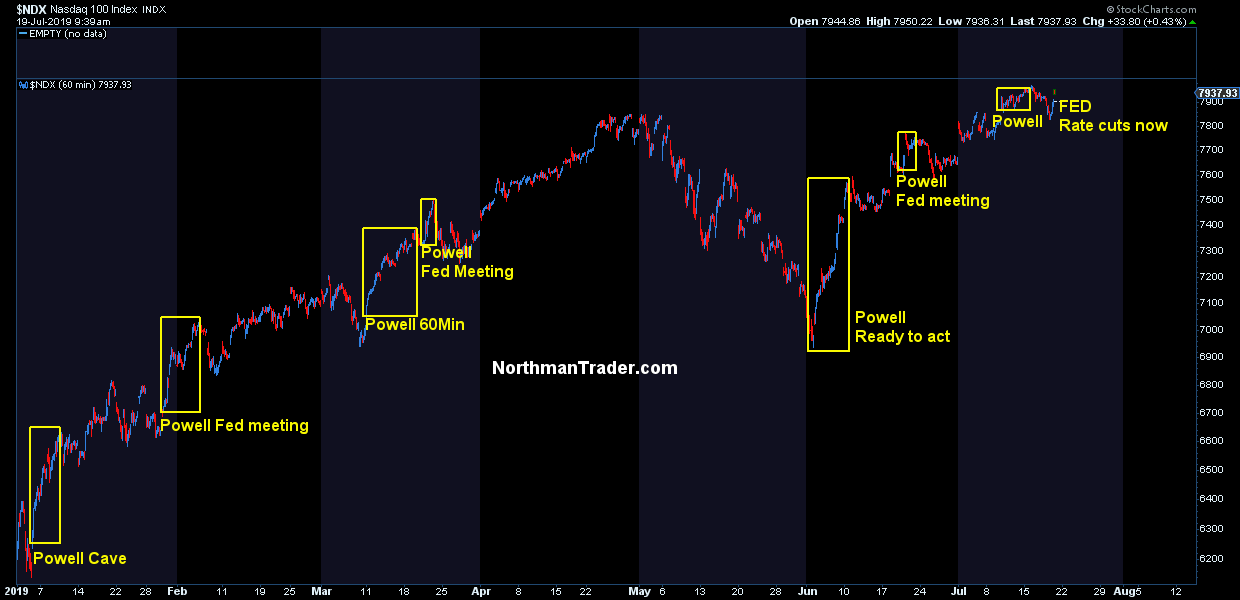

The economy has been in a record-setting bull market statistically, but real wage growth, unemployment, and wealth have stagnated. The past eleven years have strengthened recency bias that distracts from broad market and economic uncertainty for the middle-class. This state has especially impacted young adults and millennials who only remember positive growth and economic prosperity while transitioning into adulthood and the real world. We must wake up to financial responsibility, especially in times of personal financial vulnerability. Sven Henrich of Northman Trader articulates some criticism of this current state of monetary policy:

Sven highlights outdated monetary policies, like quantitative easing (QE) and other legislation that, despite plentiful time, lacked important anticipation before reaching this state. There is a need for modernized sustainable infrastructure and why we should take matters into our own hands.

In addition, it is imperative for current policies to adapt and become more malleable. Chief Executive Ross of Gerber Kawasaki investment firm simplifies one perspective of future momentum led by lagging economic data that ignore real issues today:

Ross points out how historical solutions to historical problems may not be applicable in today’s environment, may eventually make things worse, and implores his Twitter followers to think outside the box. Addressing new-age issues with fresh perspectives is necessary. There appears to be a lack of awareness that possibly old solutions are like trying to fit a square peg into a round hole of new problems.

Self-Education:

We are not alone and endure similar life and monetary struggles, especially related to overall well-being. It is important to understand this interconnected world of shared adversities. Friend groups, classmates, and coworkers are useful resources to share tips on self-care, basic budgeting, savings, and responsible habits, but we ultimately must self-educate. Luckily there exists an invisible cloud of content that can connect you with like-minded and knowledgeable individuals. The internet has enabled unlimited opportunities for self-education, but I will be focusing on Twitter. There are many respectable platforms, but Twitter is my personal choice of social media for this purpose. Twitter promotes constructive discussion among any current event, topic, debate, and feed, in which users can seamlessly personalize to seek and create their own experience. Connecting with like-minded communities to support rational decision-making is critical in personal financial management. We all need each other to continuously learn and improve ourselves, and fulfilling a financial foundation will uphold all other aspects of life to achieve true well-being.

This social media site contains countless communities of shared interests and content. Finance Twitter, or “FinTwit,” is a community of financially attentive people, organizations, parody accounts, and audiences of different backgrounds who share ideas to learn and grow personally and professionally. Accounts post everything from news, data, and current events in real-time, to articles related to personal financial planning and investing. Given its character-limited tweets, many leverage YouTube or other video platforms in addition to Twitter branding for more depth and functionality. There are many useful accounts, people, and companies to follow, but I will be sharing my personal favorites below.

Most news stories are often delayed and reactionary. Twitter doubles as an information instant-gratifier and can notify audiences in real-time. It is important to stay up to date with current events, especially related to relevant financial planning advice. MarketWatch is a free conglomerate of financial news, stock data, and current personal finance articles aggregated into one. This site is easy to navigate and promotes its presence on Twitter, oftentimes shared amongst community members, with insightful relevant commentary on the current hidden personal financial planning crisis:

Millennials are the new face of the retirement crisis

And helpful, direct advice:

A less formal but timelier accurate, community-based news hub I recommend is ZeroHedge. They publish global news updates, articles, statistics, and information geared more toward the individual. There is a wide range of knowledge assumptions targeted toward different audiences, but ZeroHedge provides informative tools for the average person:

Mindful consumption and spending habits add up. But what about beyond budgeting?

Entrepreneurs like Dalton actively try to educate young adults. He offers informative advice for beginner-level investing, a basic understanding all adults should become familiar with. In his YouTube series, Dalton highlights how advantageous it is to start early. Dalton may be young but is extremely knowledgeable and self-taught. He took matters into his own hands at an early age, realized the current state of personal finance, and is already trying to help other people. He also provides insight into helpful apps like Robinhood, a new-age investment tool that every young person should look into:

Following accounts like these are free investments into your own growth initiatives toward financial well-being. Time is money, and time spent educating yourself will literally pay dividends.

So what?

Remaining vigilant to current events, continuous knowledge expansion, and proactive decision-making are imperative for responsible financial planning. I admit, I enjoy memes, but utilizing some social media time to invest in your future is more useful than worthless scrolling. This online community exemplifies optimal knowledge sharing and is an example of useful content to surround and educate yourself with. It is also a good idea to exercise your brain. Mental health is crucial to build personal growth and cultivate a strong sense of self, think clearly, and make smart decisions. Collective discourse and collaboration will end the stigma of financial vulnerability and embarrassment that has distracted meaningful education of Adulting 101.

A handful of keys:

1. Mindful Consumption

Before every purchase, no matter how big or small, ask yourself “Do I really need this? Can I afford it? If not, what adjustments can I make to fulfill this need?” For example, if you are like many who wake up Sunday wondering where your paycheck went, it may be time to cut back on costly weekend festivities.

2. Self-Education

Education does not stop at your degree. It is imperative to gain a grip on your financial situation, understand the economic environment, and situate yourself for adversity. Continuous improvement of knowledge is necessary to adapt to your dynamic financial situations throughout life milestones. We must continuously adapt.

3. Strategic Planning

Maintain long-term perspectives and make thoughtful risk-adjusted decisions. Saving for retirement is half the battle. You must save for other life events like buying a car, buying a home, raising a family, and so on. Start planning for short and long term goals, big purchases, vacations, and so on as soon as possible.

4. Composure in Good and Bad Times (Don’t Get Greedy)

Money can provide peace of mind, but greed is the root of all evil. Luck tends to favor responsible individuals. Do not let the luck of others distract you. More importantly, do not become envious of the fortunes of others. You must focus on what is in your control and let the rest handle itself. “You can be right and still be a moron.”

5. Protect Your Capital

You work hard for your money, do not disappoint your future self with unfavorable financial decisions. The government already takes a quarter of your paycheck, so why carelessly give more away? There are 3 certainties in life: financial uncertainty, death, and taxes. The classic game of Monopoly highlights this unfortunate truth:

Bottom Line:

Be financially proactive now so that you have more time later to worry less and live more.