From Flags To Riches

A Historical Overview of US Banking, Dynamic Monetary Policy, and Future Trends

The United States Dollar has evolved from a token of revolutionary independence to a matured world reserve currency. Like its predecessors, its power as a monetary system has mirrored that of political influence among socioeconomic factors and the global economy. The desire to break away from the British Empire’s tyrannical governance and start fresh helped guide our Founding Fathers’ idea of New World banking and economic frameworks. Establishing a new country built on a democratic republic, combined with capitalism and dominant military forces, had set the foundation for flourishing innovation and (eventually) sustained prosperity. This journey has been highlighted by wars, counterfeiting, technological improvements, and a centralization of powers. Throughout history, external conflicts and internal crises tended to precede drastic monetary interventions. By examining this evolution, inflection points, and prior dominant countries, we can better understand the complexities of current events and anticipate future probabilities.

Key Events That Shaped The US Banking System:

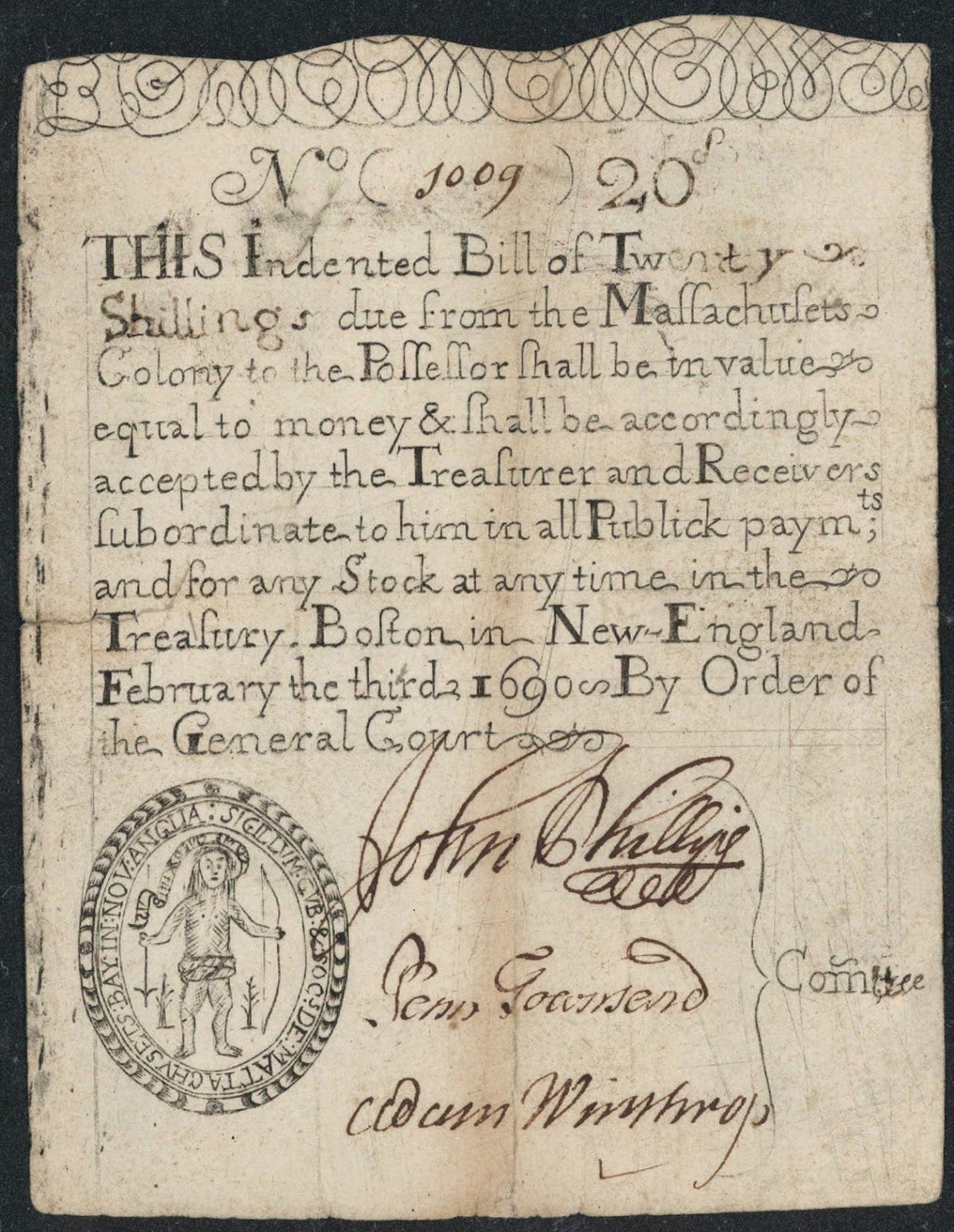

The Introduction of Colonial Notes - 1690

In order to fund British military expeditions, the Massachusetts Bay Colony issued the first paper currency in the territorial United States. This act encouraged neighboring colonies to follow suit with their own paper notes, thus a new banking experiment was born. There was no umbrella currency to denominate among regions, so exchange rates continued to fluctuate and be set by trading goods and services in the free market.

Continental Currency - 1775

The Continental Congress voted to issue a unified currency for opposing British control and finance the Revolutionary War. After initially approving $2 million bills of credit, they unexpectedly continued to increase issuance for several years to fund American forces and combat British counterfeiting. By the end of the decade, the total supply of these bills had increased 120-fold to over $240 million. Of course, the pain of hyperinflation was not cared for until after defeating the British in 1783 and becoming successfully recognized as independent. This mindset of winning at literally all costs would continue throughout future conflicts.

The First Bank of the United States - 1791

The inaugural Secretary of the Treasury, Alexander Hamilton, created the first pseudo-central banking system for the US government. Congress had chartered this after adopting the Constitution and authorized their issuance of bank notes to simplify domestic trade and lending. They officially incorporated the term “dollar” and its “$” symbol 6 years prior as the common unit of currency. This symbol was inspired by the Spanish peso, as shown below:

The Bank Panic - 1837

This was a financial crisis that occurred in the United States during the presidency of Martin Van Buren. It was caused by a combination of factors, including over-speculation in land and railroad investments, the issuing of paper money without proper backing, and the failure of numerous state-chartered banks. This crisis led to widespread bank failures, bankruptcies, and high unemployment rates. In response to the crisis, Van Buren established the Independent Treasury System, which ended the practice of depositing federal funds in private banks and created a heavier government-controlled system for storing and disbursing funds.

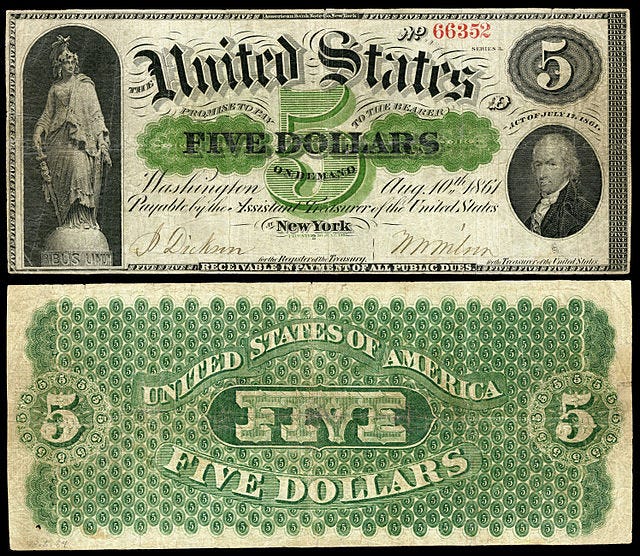

The National Banking Act - 1863

The National Banking Act of 1863 was a law passed by the US Congress during the Civil War. It was created in response to the need for a more stable national currency and reliable banking system to fund the war effort. On the brink of bankruptcy and pressed to finance the war, Congress authorized the Treasury to issue paper money for the first time in the form of non-interest-bearing Treasury Notes called Demand Notes. These Demand Notes were replaced by US Notes and commonly called “greenbacks” because of the green tint introduced to discourage photographic counterfeiting. The act established a system of federally-chartered banks that could issue standardized banknotes backed by government bonds, which provided a more stable, uniform, and anti-counterfeit currency across the country. This act laid the foundation for a nationally regulated banking system that would become a cornerstone of the US economy for many decades to come.

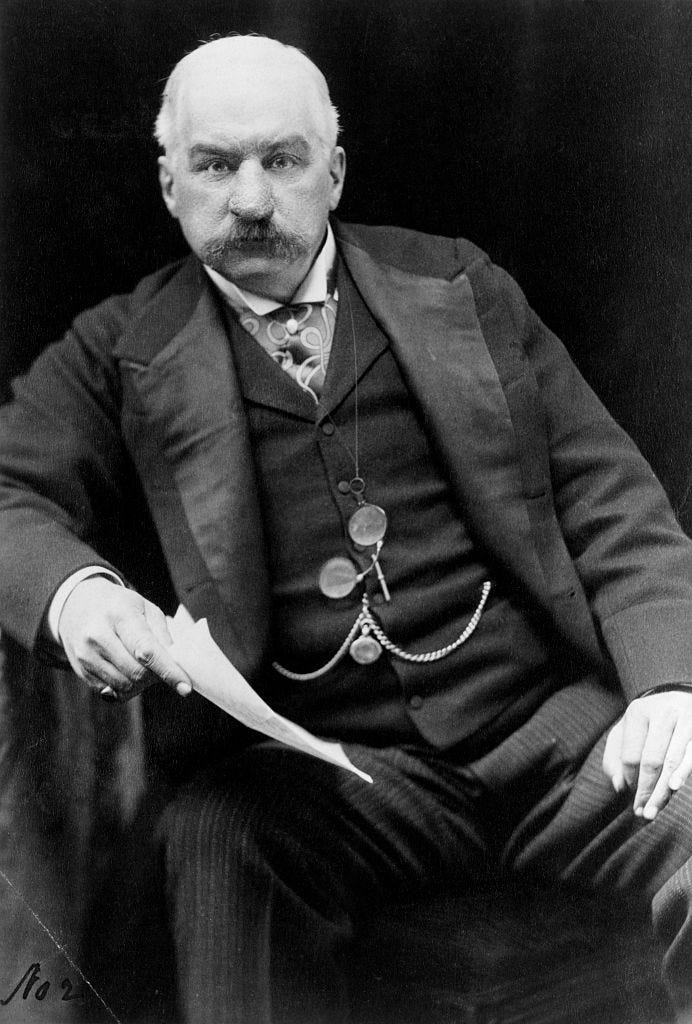

The Market Panic - 1893

After a panic in 1893 lingered, the US faced a financial crisis that threatened to bring down the entire economy two years later. President Cleveland and Treasury Secretary Carlisle had proposed a plan to sell government bonds to the public to raise $60 million, but a rapid run on the Treasury made the process unworkable. With the Treasury's gold reserves falling dangerously low to ~$9 million, below a credit held by a single private citizen for $10 million, a private bailout was necessary to prevent insolvency and stabilize the economy. Enter Wall Street financial baron John Pierpont (JP) Morgan. An imploding government was not good for his steel business, and Morgan understood that what was good for the U.S. Treasury was also good for his business. Despite Cleveland's initial reluctance, Morgan proposed the private sale of government bonds to his syndicate. In return, Morgan would give the Treasury the gold it needed, $100 million, to meet its current and anticipated obligations. It was all quite legal, but politically dangerous for the President as Wall Street did not have a good rep among Main Street. Morgan's bailout succeeded in stopping the run on the Treasury, and the economy took off. While Morgan's actions may have been motivated by profit, patriotism, or some combination thereof, there is no denying that he saved the nation when no one else stepped forward. This episode highlights the complex relationship between government and finance and the power dynamics that exist within it. As one of the most powerful figures in American finance, Morgan was instrumental in shaping the future of the financial system. He played a key role in the formation of industrial trusts and monopolies and was a major player in the creation of the Federal Reserve System. Morgan's influence on the financial system was both positive and negative. On the one hand, he helped modernize and stabilize the system, laying the foundation for America's rise to economic superpower status. On the other hand, his actions contributed to the concentration of wealth and power in the hands of a small group of financiers, leading to concerns about the dangers of excessive concentration of financial power that would continue to this day.

The Federal Reserve Act - 1913

The Federal Reserve Act of 1913 was a law passed by the United States Congress that created the Federal Reserve System, which remains the central banking system of the United States today. The act was passed in response to a series of financial panics in the late 19th and early 20th centuries, including the Panic of 1907. The Federal Reserve System was designed to provide a stable and flexible monetary and banking system that could respond to economic crises and ensure the stability of the US financial system. The act created a system of twelve regional Federal Reserve Banks that would act as a lender of last resort and regulate the money supply through the buying and selling of government securities. It was a significant milestone in the evolution of monetary policy in the United States, giving the government greater control over the money supply and the ability to respond to economic crises. The book "Creature from Jekyll Island" by G. Edward Griffin is a critique of the Federal Reserve System, arguing that it is controlled by a powerful group of bankers and has been responsible for many of the economic problems in the United States, contrary to its initial intent.

The Federal Reserve Act was motivated by Keynesian economics, which emphasizes the role of government in managing the economy and using monetary policy to stabilize economic cycles. Keynesian economics holds that government intervention in the economy, such as fiscal stimulus and monetary policy, can mitigate economic downturns and reduce unemployment. However, Austrian economics takes a different approach. It emphasizes free-market principles and minimal government intervention in the economy. According to Austrian economics, government intervention in the economy often leads to distortions and misallocations of resources, which can create economic instability and harm the long-term prospects of the economy. For example, they contend that artificially low interest rates set by the Federal Reserve can encourage malinvestment and create economic bubbles, which can lead to economic instability and financial crises, only to be “saved” by reversing policy and harming the non-wealthy.

The Great Depression - 1929

The Great Depression was a severe economic downturn that lasted from 1929 to 1939, affecting countries around the world. The Great Depression followed the opposite prosperous “Roaring Twenties” and was triggered by the Black Tuesday stock market crash of 1929, which led to a widespread decline in economic activity and a wave of bank failures and business bankruptcies. The causes of the Great Depression were complex, but included over-speculation in the stock market, a contraction of the money supply, and a decline in consumer spending. The Great Depression had a profound impact on the evolution of monetary policy in the United States, leading to the implementation of several key measures to prevent similar crises in the future, including the creation of the Securities Act of 1933, the Securities Exchange Act of 1934, the Federal Deposit Insurance Corporation, and the Social Security Act. The Great Depression ultimately paved the way for the development of Keynesian economics, which emphasized the role of government intervention in stabilizing the economy and promoting full employment.

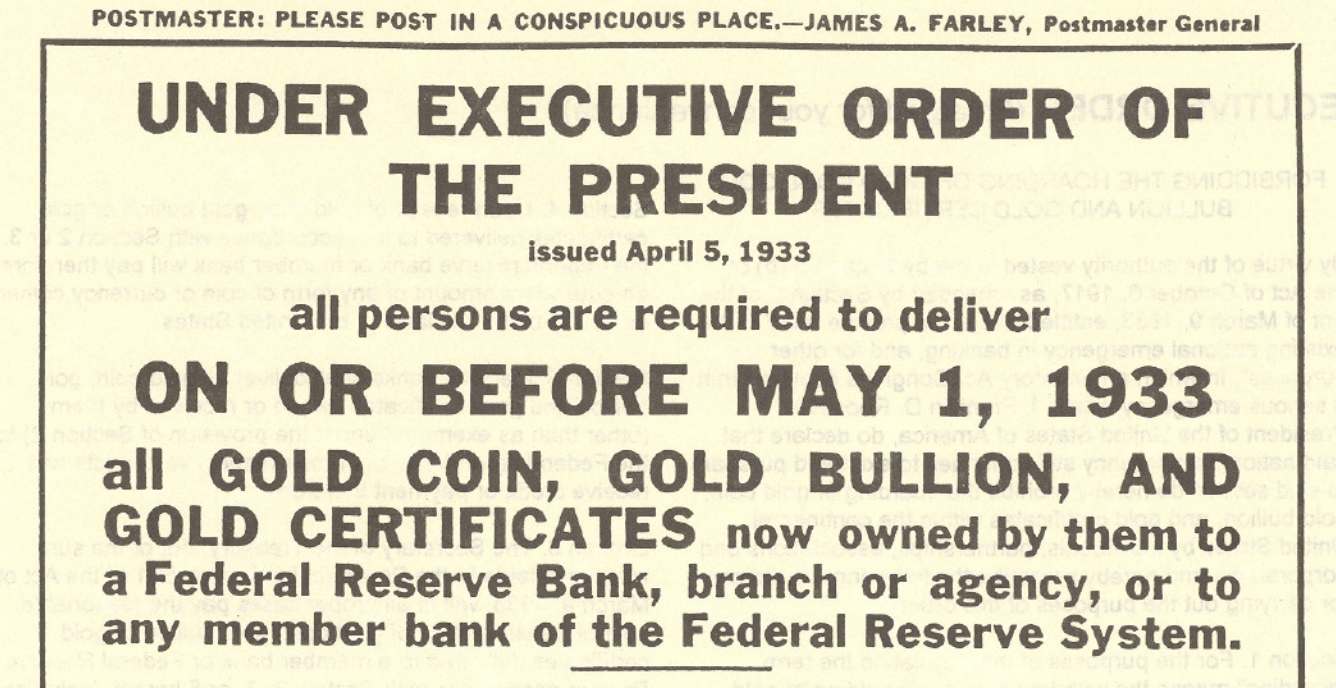

Executive Order #6102 - 1933

Executive Order 6102 was signed by US President Franklin D. Roosevelt on April 5, 1933, during the Great Depression. The order made it illegal for US citizens to own or trade gold, and required them to surrender all gold coins, bullion, and certificates to the Federal Reserve by May 1, 1933. The purpose of the order was to “stabilize” the US economy and banking system by removing gold from circulation and allowing the government to fully control the money supply. The order remained in effect until 1974 when President Gerald Ford signed a bill again legalizing private ownership of gold (after President Nixon removed the US Dollar from being backed by gold 3 years prior).

The Bretton Woods Agreement - 1944

The Bretton Woods Agreement took place in New Hampshire and was a set of international agreements signed in 1944 by the US and other major economies. This was designed primarily to promote the post-World War II economic recovery of the United States and global peace. As the wealthiest nation post-war holding nearly two-thirds of all national gold amounts, they were able to exploit non-US countries by establishing the US dollar as the world's dominant reserve currency and by linking the value of other currencies to the US dollar. This also created several unified organizations, including the International Monetary Fund (IMF) and World Bank. This arrangement gave the US a significant advantage, as it allowed the US to run large trade deficits without having to worry about the value of its currency. Furthermore, the IMF and the World Bank were both heavily influenced by US economic interests, which led to the imposition of neoliberal economic policies on developing countries. These policies often involved austerity measures, privatization, and deregulation, which had negative consequences for many non-US countries and contributed to the widening of global economic inequality, further explained HERE. Overall, the Bretton Woods Agreement helped shape international business for decades to come by creating a system that was heavily influenced by US economic and political interests.

The Vietnam War - 1955

The Vietnam War was a complex and protracted conflict that took place from 1955 to 1975, resulting in over 1 million casualties. The US government financed the war effort through a combination of tax increases, deficit spending, and the issuance of war bonds to the public. War bonds were a way for ordinary citizens to lend money to the government to fund the war effort, and they proved to be an effective method of raising funds. In total, the U.S. government issued more than $185 billion in war bonds during the course of the conflict. However, the high cost of the war, combined with inflation, led to a significant shift in U.S. monetary policy in the early 1970s.

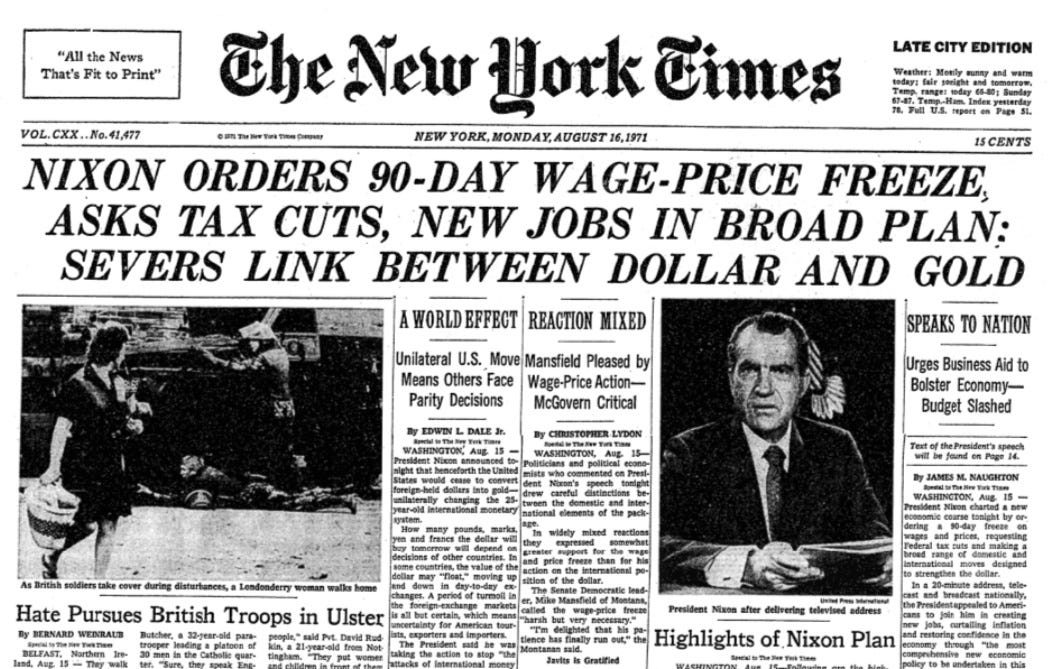

Nixon Removes Gold Standard - 1971

President Nixon's decision to end the convertibility of the U.S. dollar into gold marked a significant turning point in the evolution of monetary policy. Prior to this decision, the U.S. dollar had been backed by gold, and foreign countries could exchange their dollars for gold at a fixed rate. This system, known as the gold standard, had been in place since the end of World War II. Nixon's decision effectively abandoned the gold standard and transitioned to a system of floating exchange rates, which allowed the value of the dollar to fluctuate in response to market forces. The end of the gold standard had significant effects on the global economy, with some experts arguing that it led to increased volatility and instability in financial markets. However, others argue that it paved the way for greater economic growth and stability in the long run. Regardless of the effects, the end of the gold standard marked a significant turning point in the history of monetary policy and had a lasting impact on the way that governments approached fiscal policy. More information about the effects of removing sound money can be found at WTF Happened in 1971?

The Monetary Control Act - 1980

The Monetary Control Act of 1980 was a significant piece of legislation that had far-reaching implications for the U.S. economy. The Act was passed in response to a period of high inflation and economic instability that plagued the country throughout the 1970s. During this time, the U.S. government had relied heavily on deficit spending to fund its programs and had effectively abandoned the gold standard. This Act aimed to address these issues by providing the Federal Reserve with greater control over the money supply, and required all depository institutions, such as banks and credit unions, to hold reserves with the Federal Reserve. It also established reserve requirements for these institutions, which helped to ensure that they had sufficient funds on hand to meet the demands of their depositors. One of the key provisions of the Act was the creation of the Depository Institutions Deregulation Committee (DIDC), which was responsible for phasing out interest rate controls on deposits and loans. This allowed banks to compete more freely with one another and helped to drive down the cost of credit for consumers and businesses. Today, the Act remains an important part of the regulatory framework that governs the U.S. financial system.

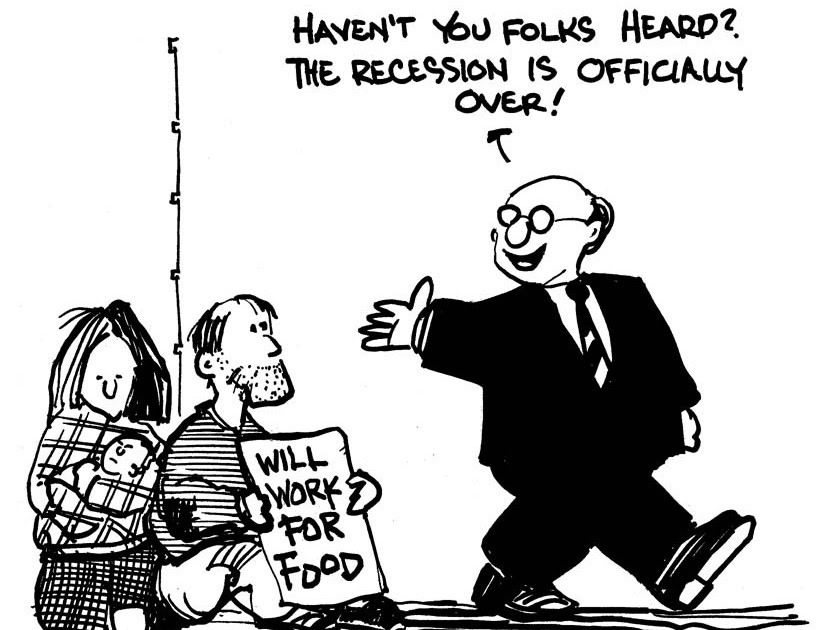

The Dot-Com Bubble - 2000

Also known as the tech bubble, this was a period of rapid growth and expansion in the technology industry that took place in the late 1990s and early 2000s. The bubble was fueled by a wave of new companies entering the market, as well as by the growth of the internet and the increasing popularity of online commerce. During this time, many investors poured large sums of money into tech stocks, expecting them to continue to rise in value. However, as the bubble grew larger and larger, many of these companies were revealed to be overvalued and unsustainable, leading to a sharp decline in stock prices. In response to the bubble, the Federal Reserve took several measures to address the economic instability that had been created. One of the key actions taken by the Fed was to lower interest rates, which helped to stabilize the markets and prevent a more severe economic downturn. It highlighted the importance of monitoring asset prices and identifying potential bubbles before they burst. In the years following the bubble, the Federal Reserve adopted a more proactive approach to monetary policy, paying closer attention to asset prices and using a range of tools to prevent bubbles from forming in the first place. However, these measures did not outright stop them from occurring.

The Great Recession - 2008

The Great Recession was a significant period of economic downturn that began in 2008 and lasted for several years. The recession was triggered by a number of factors, including the collapse of the housing market, a series of major bank failures, and a global financial crisis that spread across the world. During the Great Recession, the Federal Reserve took several steps to address the economic instability that had been created. One of the key measures taken by the Fed was to lower interest rates to near-zero levels (ZIRP), in an effort to encourage lending and stimulate economic growth. The Fed also engaged in a process of quantitative easing (QE), which involved purchasing large amounts of government bonds and other securities in order to inject money into the economy and boost spending. It demonstrated the importance of taking proactive measures to address economic instability and highlighted the need for more rigorous regulation of financial institutions. In the years following the recession, the Federal Reserve continued to use a range of tools to promote economic growth and stability as crises spread to Europe and North Africa, and included maintaining low interest rates and engaging in targeted interventions to address specific economic challenges. The lessons learned from the recession continue to shape the way that the U.S. approaches monetary policy today, with a greater emphasis on proactive intervention and careful regulation of financial institutions.

The 2019 Repo Market Crisis

The Repo Market Crisis of 2019 was a period of financial instability that began in September of that year and lasted for several weeks. The crisis was triggered by a shortage of liquidity in the repurchase agreement (repo) market. The repo market is a critical part of the financial system, allowing banks and other financial institutions to access short-term funding by pledging collateral such as Treasury securities. In September 2019, a combination of factors led to a sudden shortage of liquidity in the repo market, causing interest rates to spike and disrupting the normal functioning of the financial system. Some analysts attributed the crisis to regulatory changes that had reduced the amount of reserves held by banks, making it more difficult for them to access short-term funding when needed. To address the crisis, the Federal Reserve engaged in a series of interventions, including injecting liquidity into the repo market and purchasing Treasury securities to increase the supply of available collateral. This crisis highlighted some of the ongoing challenges in the evolution of monetary policy, particularly around the regulation of the financial system and the management of liquidity in times of stress. While the crisis was ultimately contained, it served as a reminder of the importance of proactive intervention by central banks in times of economic stress.

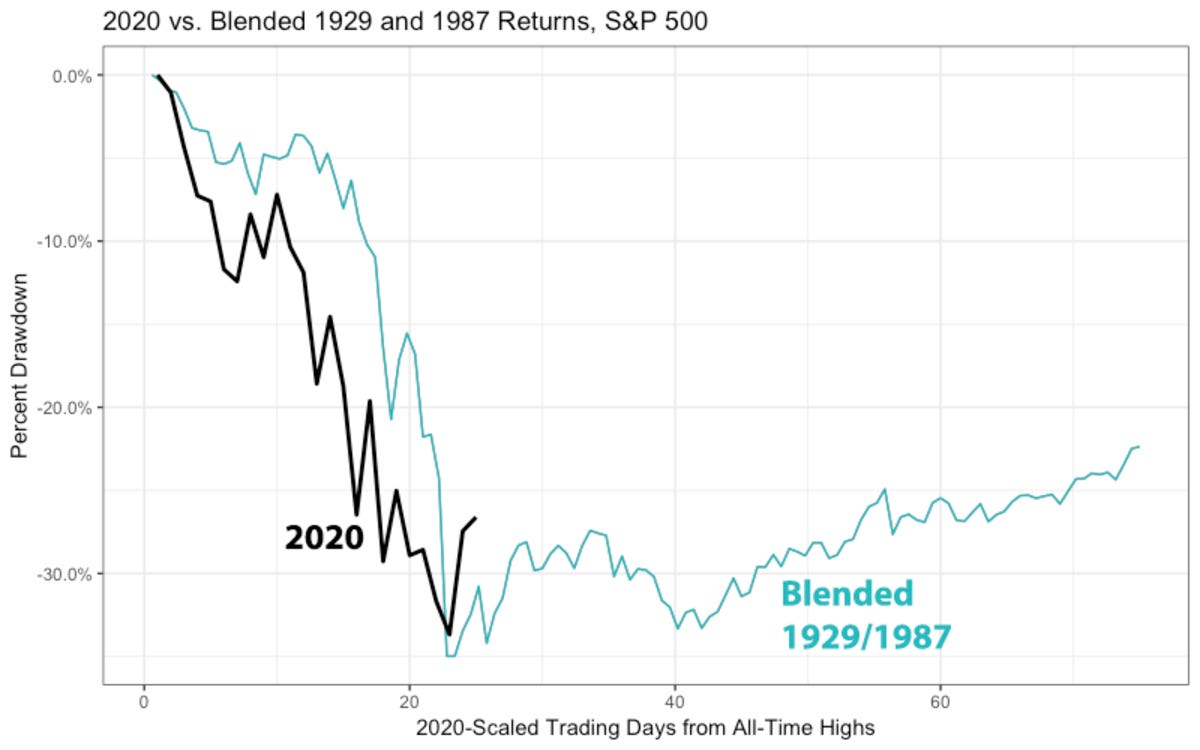

The COVID-19 Pandemic - 2020

The Covid-19 pandemic has had a profound impact on the global economy and financial system, leading to a significant shift in monetary policy around the world. Governments triggered widespread shutdowns and disruptions to supply chains, leading to a sharp decline in economic activity and a surge in unemployment. In response, governments and central banks around the world implemented drastic fiscal and monetary measures to stabilize markets and support economic recovery. On the fiscal side, many countries implemented large-scale stimulus packages, including direct payments to individuals and businesses, expanded unemployment benefits, and loans and grants to affected industries. These measures were designed to mitigate the economic impact of the pandemic and support households and corporations during the crisis. On the monetary side, central banks around the world implemented a range of measures to stabilize financial markets and support liquidity. These measures included cuts to interest rates, asset purchases, and lending programs to banks and other financial institutions. The Federal Reserve, for example, implemented a number of emergency lending programs, expanded its asset purchase program, and cut interest rates to near-zero levels in response to the economy’s standstill. Overall, the Covid-19 pandemic has had a profound impact on the global economy and financial system, leading to unprecedented fiscal and monetary measures to support recovery and stability at the time. However, the subsequent record inflation in consumer prices and assets would prove harmful to the global banking system undergoing havoc today.

The Banking Crisis - 2023

The 2nd and 3rd largest bank failures occurred at the beginning of March 2023, largely due to risk management and the whiplash in policy changes post-pandemic. Many are worried the banking system of the United States is experiencing irreparable damage as cracks unfold. There are concerns that the Federal Reserve may have caused this collapse and hindered the US banking system’s credibility. Unlike in 2008 when the system was plagued by bad credit in bank portfolios and loose regulation, this problem is drastically different. Bank portfolios are entrenched with long-duration bonds such as “risk-free” US Treasuries and Mortgage-Backed Securities. In 2020, the Fed began COVID-monetary-expansion with the greatest accommodation in history. This allowed for virtually free access to unlimited money for all, resulting in a huge rise in deposits by tech and bio startups and loan arbitrage for banks.

Unfortunately, allowing the cost of money to be zero has major consequences, one of which is inflation. By 2022, the US had recorded inflation numbers of 20% or more annually for those who wanted to buy a house, and the highest basket-ranked CPI in 50 years. The Fed’s unlimited money printing had encouraged banks to take on unlimited deposits and loans while holding long-duration bonds, instead of non-yielding cash. Attempting to fix this resulted in the fastest Fed rate hike cycle ever. This meant that interest rates went up and caused the prices of fixed-rate bonds to fall. Unfortunately, banks were heavily invested in these bonds, which meant that they were losing money and had to sell at massive losses to cover cash withdrawal demands by their clients. This situation is not just affecting a couple of banks, but the entire US banking system and even spilling into Europe. And it is not over.

Every non-large bank is facing the same issue, which is reminiscent of the 2008 financial crisis. Governments are now backstopping client deposits with loans valuing defunct collateral multiples above their fair amounts. Now, irresponsible monetary policy has driven the US banking system towards questionable insolvency, causing a loss of trust in the Fed among many. This has led to concerns that the Fed is no longer in control and that the value of the dollar is uncertain. As a result, portfolio managers are now thinking about their exit strategies, and confidence in the banking system is at an all-time low. Even countries are eying ways to mitigate dependence on the US Dollar and its treasury derivatives, like France which settled the first ever liquified natural gas (LNG) trade in Communist China’s native yuan. Now the Fed is struggling between taming inflation and plugging up holes in the banking system, which come at the cost of one another. What will happen next?

The Bottom Line

Over the centuries, the US banking system played a crucial role in the country's development and growth, fueling industrialization and innovation. The establishment of the Federal Reserve in 1913 marked a significant inflection point in US banking history, as it gave the government greater control over monetary policy and the ability to stabilize the economy during times of crisis. However, despite the success of the US banking system, the country has also experienced several significant financial crises throughout its history. Today, the US faces significant challenges related to its debt and monetary policy. The country has one of the highest debt-to-GDP ratios in the world, which is projected to continue to grow in the coming years. This high level of debt, coupled with low interest rates, has led to concerns about the sustainability of US monetary policy. The US banking history provides a fascinating lens through which to examine the rise and fall of previous world powers. While the system has played a critical role in the country's development and growth, it has also faced significant challenges and crises.

There are several patterns we can draw from past world reserve currency failures that can help us understand the current state of things. One of the most significant is the relationship between debt levels and the long-term sustainability of a reserve currency. In the past, countries that have relied heavily on debt to finance their economies have often experienced significant economic downturns, leading to a loss of confidence in their currency. For example, in the 1920s, Germany's heavy reliance on debt led to hyperinflation and the eventual collapse of the German mark. According to data from the US Treasury, the national debt stands at nearly $32 trillion, with the debt-to-GDP ratio hovering around 134% and expected to steadily increase for decades to come. This high level of debt has raised concerns about the long-term sustainability of the US dollar as a reserve currency, particularly as interest rates remain low and inflation rises, and depends on extremely optimistic GDP growth to offset detrimental impacts.

Another pattern we can identify is the role of international trade and the willingness of other countries to hold a particular currency as a reserve. In the past, countries that have dominated international trade, such as the British Empire in the 19th century, have often seen their currency become a global reserve currency. However, as other countries gain economic power and begin to challenge the dominance of the incumbent reserve currency, the likelihood of a currency shift increases. In the case of the US, China's growing economic power and increasing use of its own currency, the yuan, in international trade has raised questions about the future of the US dollar as a reserve currency. According to data from the International Monetary Fund, the US dollar accounts for around 60% of global foreign exchange reserves and is steadily decreasing. China's increasing economic influence and efforts to promote the yuan as an alternative reserve currency suggest that the US dollar's dominance may be challenged in the years to come, as Ray Dalio opines in his book “The Changing World Order.” The history of world reserve currency failures provides important context for understanding the current state of the US banking system. High levels of debt, coupled with the growing economic power of other countries, suggest that the long-term sustainability of the US dollar as a reserve currency may be in question. It is essential to analyze and interpret current events to help us make informed decisions about our wealth preservation and the future global economy. Even our Founding Fathers had reservations about this approach:

“Paper money has had the effect in your state that it will ever have, to ruin commerce, oppress the honest, and open the door to every species of fraud and injustice.”

George Washington to J. Bowen 1787

“I wish it were possible to obtain a single amendment to our constitution. I would be willing to depend on that alone for the reduction of the administration of our government to the genuine principles of its constitution; I mean an additional article, taking from the federal government the power of borrowing.”

Thomas Jefferson, Letter to John Taylor, November 26, 1798

“Bank-paper must be suppressed, and the circulating medium must be restored to the nation to whom it belongs.”

Thomas Jefferson to John Wayles Eppes in 1813

“And I sincerely believe with you, that banking establishments are more dangerous than standing armies; and that the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale.”

Thomas Jefferson to John Taylor, 1816

“All the perplexities, confusion and distress in America arise, not from defects in their Constitution or Confederation, not from want of honor or virtue, so much as from the downright ignorance of the nature of coin, credit and circulation.”

"If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered.... I believe that banking institutions are more dangerous to our liberties than standing armies.... The issuing power should be taken from the banks and restored to the people, to whom it properly belongs."

Thomas Jefferson

From Riches To Rags?

Ray Dalio's book "The Changing World Order" offers a unique perspective on the rise and fall of world powers and their currencies, and how these changes are tied to the evolution of the global economy. Dalio argues that throughout history, there have been long-term economic cycles, which he calls "long-term debt cycles." These cycles are characterized by periods of growth and prosperity, followed by periods of debt accumulation, economic crisis, and restructuring. Dalio asserts that these long-term debt cycles have played a critical role in shaping the rise and fall of world powers and their currencies. In the United States, the history of banking has been closely tied to the country's position as a global superpower. As we discussed above, the US banking system played a crucial role in financing the country's industrialization and growth, which helped to establish it as a major economic power. However, this growth was not without its challenges, as the country has experienced several significant financial crises throughout its history and even today. Dalio's book argues that the United States is currently in the late stages of its long-term debt cycle, which has significant implications for the country's future as a global economic power. According to Dalio, the country's high levels of debt and growing income inequality are leading to a decline in social cohesion, which is making it difficult for the country to address its economic challenges. The forced politicization of seemingly every narrative supports this polarity.

One of the key themes in Dalio's book is the idea that power and wealth are shifting from the West to the East. China is emerging as a major economic power, and its rise is challenging the dominance of the United States. The Chinese banking system is playing a critical role in this shift, as China is rapidly expanding its global financial influence through initiatives such as the Belt and Road Initiative. Dalio also highlights the importance of innovation and technological progress in shaping the future of the global economy. The United States has been a leader in innovation and technological development, and this has helped to drive its economic growth. However, China is now investing heavily in innovation and technological development, which could position it as a global leader in the future. Dalio's book offers a compelling perspective on the rise and fall of world powers and their currencies. The history of US banking is closely tied to this story, as the country's banking system played a crucial role in its emergence as a global superpower. However, as the United States enters the late stages of its long-term debt cycle, it faces significant challenges that could impact its future as a global economic power. The rise of China and its social credit dystopia of a digital banking system is also playing a critical role in shaping the future of the global economy, highlighting the importance of innovation and technological progress in determining the winners and losers of the changing world order.

The current digital era has the potential to reshape the way we think about money and banking systems. While China has emerged as a major player in the global economy, the rise of Bitcoin as a decentralized digital asset presents an intriguing, apolitical, and permissionless alternative to traditional banking systems. Bitcoin operates on a decentralized blockchain network that allows users to truly self custody the asset and transfer value without the need for a central authority. This system provides several advantages over traditional banking, including lower transaction fees and greater privacy and security. Additionally, Bitcoin is not subject to the same inflationary pressures as government-backed currencies, as its supply is limited to 21 million coins, backed by math and real-world energy instead of guns and government trust. While Bitcoin has faced significant skepticism and regulatory hurdles, its potential as a viable alternative to traditional banking systems cannot be ignored. The current economic landscape, with its high levels of debt and low interest rates, highlights the need for innovative solutions to ensure the long-term sustainability of the global economy. As we enter the early innings of the digital Information Age, it will be interesting to see how the role of banking systems evolves.

While traditional banking will likely continue to play a significant role in the global economy, the potential of Bitcoin to positively disrupt the status quo cannot be overlooked. As families who try to preserve our wealth and purchasing power over the long-term, it is our responsibility to analyze and contextualize these shifts, and to consider the future implications for the world economy. In the meantime, increase your Bitcoin knowledge, understanding, and allocation above “0”, aka Get Off Zero:

Disclaimer:

The above content and resources are for educational purposes only and not financial advice. Should you choose to apply the practices described in the above and/or linked content with bitcoin you own now or may purchase in the future, you do so at your own risk and I shall in no event be liable for any financial loss suffered.